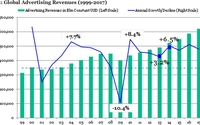

After a relatively tepid year in which the world's ad economy expanded only 3.2%, the ad industry's rate of growth will more than double to 6.5% in 2014, according to the latest

estimates from Interpublic's Magna Global unit. The new forecast, which is being released this morning as part of a series of major agency ad outlooks at UBS' annual media conference in New York,

represents an increase of four-tenths of a percentage point over the 6.1% rate of growth Magna previously projected for 2014.

The improvement is even better in the world's largest ad market,

the U.S., on a relative basis -- expanding from only 1.3% in 2013 to a growth rate of 5.5% in 2014, thanks in large part to the stimulus of digital media, especially social, mobile and programmatic

media-buying.

advertisement

advertisement

“Compared to our previous forecasts published in June 2013, the biggest game-changer was the rise of social media and, more specifically mobile social media,” writes

Magna Director of Global Forecasting Vincent Letang in the new report being released this morning. “In the last 18 months, social media usage has migrated toward portable devices and platforms

at a faster rate than most anticipated. By ‘portable’ we refer to mobile phones and tablets. It needs to be stressed that portable devices are increasingly used in the home and not just on

the move; they are not only filling a media-free space in consumers' days, they are also gradually replacing laptops and PC usage in the home. In fact, they have become the default devices for casual

Internet usage at home and the dominant platform for digital social media usage everywhere.”

As a result of the dynamic “chemistry” of social and mobile expansion, Letang

estimates “social media advertising grew by 58% this year to $9.1bn, of which $2.9bn from mobile social (+300%).”

Letang says only part of that expansion is

“incremental,” and that a significant share is “substitutive,” cannibalizing on ad budgets that would have been allocated to other media.

“Overall, we believe it

is slightly incremental and that is partly why we have seen stronger digital media growth than anticipated in 2013 (nearly +16% compared to our previous forecast of +13.4% in June). Globally, the $118

billion spent with digital media represents 24% of global advertising revenues,” he estimates.

Other digital advertising sectors, particularly paid search and online video, also

continued healthy expansions in 2013 (rising 18% and 37%, respectively), but the other “big trend,” according to Magna, has been the “rise of programmatic trading. Magna, a unit of

Interpublic's Mediabrands that has been aggressively pushing automation and programmatic trading, estimates the programmatic marketplace reached $12 billion worldwide, and $7.4 billion in the U.S. in

2013.

Magna reaffirmed its prediction that the global programmatic marketplace would expand to $32 billion by 2017, thanks in large part to the “non-RTB,” or direct deals with

publishers utilizing programmatic automation.

“During 2013, premium publishers came together to form ‘co-ops’ - programmatic sales houses aimed at sharing technology costs

and keep a level of control on the value their inventory,” Magna cites as one example of the maturation of the programmatic market dynamics influencing the market's growth.