DallasNews Corp. has received new support in its

fight to be sold to Hearst, and not to Alden Global Capital.

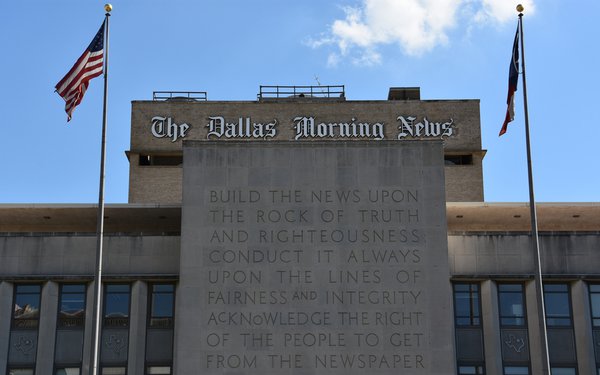

Glass, Lewis -- a proxy advisory firm -- has recommended that shareholders vote for the merger of the company, which

publishes The Dallas Morning News, with Hearst.

The price will be $15 per share in cash, 242% over the closing price of $5.30 per share of Series A Common Stock, on July

9.

“DNC [DallasNews’] investors are receiving both a material market premium and a control valuation well in excess of the Company’s standalone arc,”

Glass, Lewis says.

Another opinion was offered by J.P. Morgan Securities LLC (“JPM”), which was retained by the DallasNews Corp. board as an external financial

advisor.

Initially, JPM’s methodology “yielded an equity reference range of $8.10 to $8.45 per share.”

advertisement

advertisement

JPM now says, "The revised terms from Hearst, at

$15.00 per share, significantly outstrip the same range, reinforcing the notion that the proposed exit does indeed represent a material premium for DNC [DallasNews] investors.”

The other

contender, Alden Global Capital’s MediaNews Group, has offered $18.50 per share in its latest non-binding offer.

But the board has rejected that offer, feeling that it was not “a

superior proposal.”