Finally, winter has departed and spring has officially arrived, so it’s now more pleasant for affluent shoppers — especially those who live in the colder and snowier parts of

the country— to get out there and start shopping again for more than the basic necessities. As shopping is often a two-phase process during which consumers first research what they are

considering buying and then actually make the purchase, how will affluent consumers research products and services and how will they actually buy them in what has become a more omni-channel retailing

marketplace in the past few years?

According to our most recent survey, when researching their planned purchases, affluent shoppers far prefer to go online (84%) rather than doing

it in person at a store (11%). For actual buying, though, closer to half of affluents (42%) choose the brick-and-mortar route compared with just more than half who go online (55%). Why? Seeing and

touching score highly as the main attractions for affluents shopping in person, especially for Boomers (50 to 68 in age) as compared with the younger Millennials (18 to 34) and the more middle-aged

Gen Xers (35 to 49). However, that preference is far outweighed by "convenience" for affluents buying online, with 60% citing that benefit, as well as "free shipping" (50%), "better price" (46%), and

"better selection" (44%).

advertisement

advertisement

Overall, the "one size does not fit all" marketing approach applies yet again, as affluent Millennials, Gen Xers, and Boomers widely differ in their

behavior when researching and buying products and services, and that is a truism that everyone who markets to affluent consumers should understand. However, the three generations largely agree in

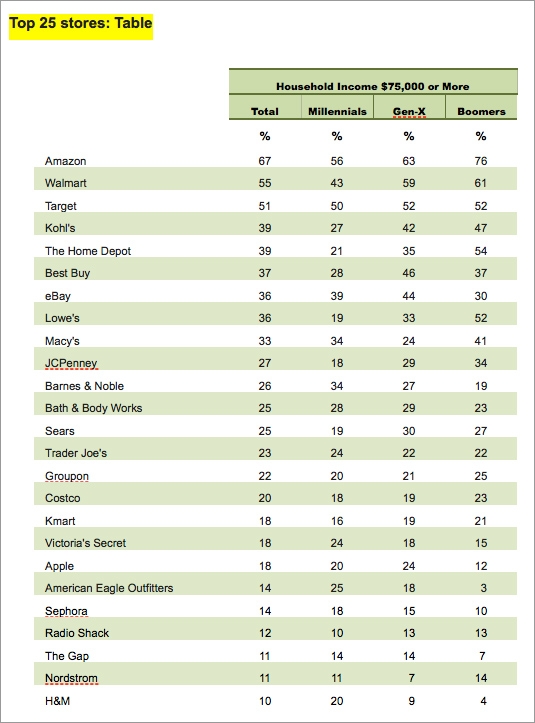

their choices of the "Top Twenty-Five Stores Where Affluents Shop" (out of the 127 store brands measured in our most recent survey).

Notably, as shown in the following

exhibit, half or more of all affluent adults have shopped at Amazon, Walmart, or Target in the past year, and these stores are ranked first, second, and third respectively for the number of affluent

consumers shopping there. Affluent Boomers are more likely than the other two generations to have shopped at Amazon; and Gen Xers and Boomers are more likely than the younger Millennials to have

shopped at Walmart.

For stores that rank in the top twenty-five but not in the top three among all affluent adults, Kohl's, The Home Depot, Lowe's, Macy's, and JCPenney, among

others, have greater appeal for affluent Boomers than for their younger counterparts. Best Buy, eBay, Sears, and Apple attract more Gen-X'ers; and Millennials are more likely than the two older

generations to shop at Barnes & Noble, Victoria's Secret, American Eagle Outfitters, Sephora, and H&M. Notably, among the top 25 stores, Nordstrom and Sephora are the only two that most

marketers would consider as upscale stores that specifically target affluent shoppers.

Looking

to the months ahead, the final March Consumer Sentiment Index from the University of Michigan’s Survey of Consumers showing optimism among the affluent at its highest level since the

third quarter of 2004, bodes well for marketers to the affluent. Indeed, those affluents’ hands that had been kept in their pockets during this harsh winter should now be out and ready to

spend.