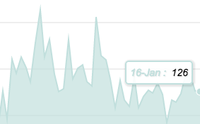

National TV ad prices fell

slightly coming into the new year after ending 2015 on a down note. Prices fell one point to an index of 126 in January, continuing a downward trend that began when December 2015 crashed 17 points

from an index of 144 in November 2015, according to the Real Cost Index, a collaboration of MediaPost and SQAD enabling readers to track the supply and demand of national TV advertising time based on

cost indexing.

On a year-over-year basis, January’s TV advertising costs are up five points from a 121 in January 2015.

January’s TV price index

compares to a 12-month high of a 206 in March 2015 and a 12-month low of a 93 in June 2015.

Demand for national cable TV appears to be stronger relative to national broadcast

advertising inventory, as cable’s ad costs rose a point to a 149 in January vs. a 148 in December 2015, and is up five points from a 144 in January 2015.

The national broadcast TV ad index

slid seven points to a 128 in January vs. a 135 in December 2015, though it is off only two points from a 130 in January 2015.

advertisement

advertisement