These days, it’s not enough to be a quality

company with engaging demos and an experienced sales team. Increasingly, media and technology sellers need to be market explainers.

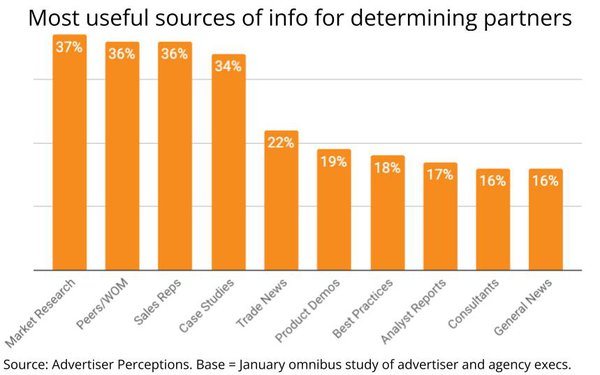

That’s what we found when we asked advertisers what

motivates them to choose a media or ad tech partner. More than half said they’re more likely to do business with a brand if they consistently get proprietary information and insights from the

company. They put white papers and webinar invitations above demos, presentations, and sales calls.

Why? Advertisers are inundated with change in consumer behavior, data, and media.

They’re confronted with dizzying choices from walled gardens, SSPs, publishers, data companies, and quality measurement solutions across video, display, social, mobile, CTV and emerging

channels. They crave credible guidance.

advertisement

advertisement

It takes more than a clever positioning to stand out, particularly in a hybrid-remote environment where sales entertaining becomes less practical as a

relationship builder. The court-side seats that once opened media budgets are being replaced by education – specifically, foresight and insight based in objective research – that makes

advertisers savvier buyers.

In fact, three in five advertisers are more likely to take a sales call with a media or ad-tech company when they know they’ll be presented with thought

leadership. They’re particularly interested in demand for a specific kind of media, the emergence of a better approach, or the ROI of an investment.

Notably, such staples of selling as

product demos and email newsletters don’t make it into advertisers’ top five preferred information formats today.

Senior-level advertisers want in-depth insights from well-known

experts or industry spokespeople. Junior-level advertisers care more if insights contain multiple points of views and sources and include a range from elementary to advanced information. Agencies are

more interested in case studies, and agency buyers want how-to information ranging from basic to advanced levels on using platforms and formats, new approaches, and sophisticated ways to measure

and calculate ROI, to name a few.

For this reason, straight-ahead intelligence works best. For example, the IAB’s “Putting COVID in Context” research paper showed advertisers

how the pandemic was changing demand, pricing, and measurement in digital media. Freewheel’s “The Changing Face of TV Advertising” white paper benchmarked emerging approaches to TV

advertising and opened the door for sales conversations. A PubMatic webinar let third-party experts explain the use and value of wrapper technology in programmatic advertising.

For the most

part, advertisers want written reports. We found 60% prioritize written content and 56% are most likely to share it over other forms. If it’s video, keep it brief; 48% of advertisers

respond to short clips that highlight key findings of a report and insights from a webinar.

When research translates to a multichannel thought leadership campaign, it’s more likely to

generate leads. The white paper, case study, or video that lives on a brand’s website needs to be siphoned into content snippets that fuel direct marketing, social media, PR, and paid

advertising directing buyers to it.

The escalating complexity of advertising necessitates a new sales game. With digital media dominated by the Big Three (Google, Amazon, Facebook), most media

and tech companies must transcend audience to distinguish their brands. Their best bet is to become market explainers and reorient sales around intelligence that delivers real value and cements

credibility.