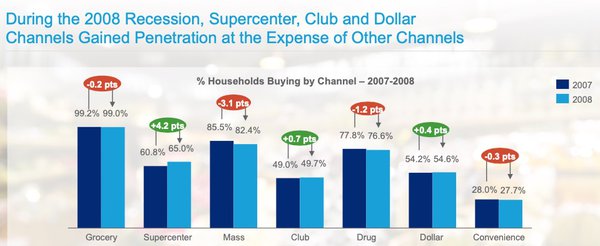

Image above: Chart courtesy of IRI.

What do economic

recessions have in common when it comes to demand for CPG products?

It’s a pertinent question, given that inflation is at a 40-year high.

The Great Recession—which

officially began in December of 2007—was a pandemic of sorts given its nationwide impact.

It was fueled by low interest rates, much-too-easy credit, toxic “sub-prime”

mortgages and, ultimately, the collapse of the housing market.

Now, talk of another recession abounds as prices for everything from food to gasoline continue to climb, and the Federal Reserve

System seeks to clamp down on interest rates.

According to the U.S. Bureau of Labor Statistics, the price of food consumed at home rose 1.5% from February to March, and was up 10% in March

year over year.

advertisement

advertisement

The highest year-over-year increases were in meats, poultry, fish and eggs (+13.7%), fruits and vegetables (+8.5%) and dairy products (+7.0%).

In a Feb. 7-21 online

survey of 2,091 shoppers by the Food Marketing Institute and The Hartman Group, many respondents noted in particular the rising prices of fresh meats, dairy and produce.

“To mitigate

rising prices, most shoppers look for deals—though some with greater urgency than others,” according to the FMI and Hartman.

“Lower-income shoppers are especially likely to

report changes to what they buy, such as switching from fresh to frozen meats.”

Krishnakumar Davey, president of client engagement at market research provider IRI, has done a deep dive

into consumer purchasing behavior data gathered during the Great Recession.

According to Davey, prices of consumer goods began to increase in the second half of 2008 and “people began

shrinking their pantries, being more mindful of their usage and buying less.”

There are differences that will play out going forward.

“Supply was not a restraint then.

Employment is actually good now,” says Davey.

In addition, some product categories did not see big price increases in 2008-2009 -- “but now it’s the overall

economy.”

Not unlike the current pandemic, eating habits changed during the Great Recession, and some brands were able to adapt accordingly.

One example Davey cites is at-home

and on-the-go breakfast became more relevant—prompting the 2010 launch of premium brand Chobani Greek yogurt. First-year sales reached $149.4 million.

Now that the yogurt category is

inundated with SKUs, what are other breakfast innovation opportunities?

“A lot of baked goods have come into breakfast in the last year or two,” says Davey. “Weight-control

liquids and powders have taken off—especially with younger generations.

“Still, a lot of people skip breakfast, even if they’re working from home. So there’s

opportunity there.”

Private-label food and beverages gained share during the Great Recession—mostly outpacing branded growth—and are poised to do the same this year, after

losing ground during the pandemic.

IRI also predicts more growth for value-channel retailers.

“Chains like Dollar General, Dollar Tree and Aldi have put so many stores out there

in the market. So we expect them to capture quite a bit of share,” says Davey.