Despite slowing growth for leading

subscription video-on-demand (SVOD) services in North America in particular, these subs grew by 17.7% to 1.34 billion on a global basis in 2021, according to a report from U.K.-based tech industry

research and advisory group Omdia.

The group is also forecasting SVOD subscriptions growth of 10.5%, to 1.48 billion for 2022, and that they will reach 2 billion annually by 2027.

That would translate to 49% growth between year-end 2021 and year-end 2027 for paid VOD services alone.

With new services continually entering the market and major players still engaged in

global expansion efforts, the market will continue to expand for several years, sums up the Global: Pay TV & Online Video Report.

Disney+, Paramount+, Peacock and others still have room

for expansion in a number of “attractive” markets, and “the prospects for the alliance of HBO Max with Discovery+ also look exciting,” comments Adam Thomas, senior principal

analyst in Omdia’s TV and online video team. “There are numerous reasons to be positive about online video’s prospects over the next few years.”

Still, with the SVOD

business having been built on high content investment and low subscription prices, “a price-sensitive public has come to expect a lot of bang for their buck,” he cautions. “The

content costs versus pricing balancing act is a tricky one to navigate, and we’ve already heard from Netflix that it expects to lose 2 million customers in this quarter. It is quite clear that

constant growth for [paid] online video is by no means guaranteed.”

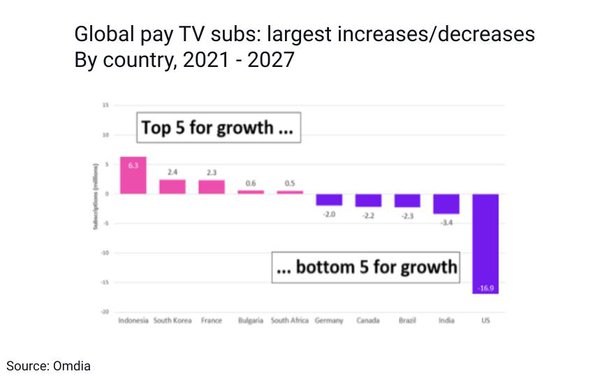

Meanwhile, thanks largely to the competition from SVOD and ad-supported video-on-demand (AVOD), global pay-TV

subscriptions edged up just 0.6% in 2021, from 1.02 billion to 1.03 billion.

Omdia projects the overall global pay-TV market to continue to experience slow decline going forward, dipping 1.9%,

to 1 billion, by 2027. (See chart top of page.)

However, pay-TV’s outlook varies markedly by country — with 6.3% growth projected in Indonesia between 2021 and 2027, and a 16.9%

decline projected in the U.S.

Of the 101 pay TV markets that Omdia

tracks in most detail, 55 countries are still reporting subscription growth, 41 are seeing decline, and five are essentially static.

Omdia expects those variances to continue over the next

five years, with countries like Indonesia continuing to post solid increases, while others -- most notably the U.S -- see ongoing decline.

Overall, the forecast calls for combined pay-TV and

SVOD subscriptions to total 3 billion globally five years from now.