Amazon may be aggressively pushing into the local

advertising marketplace, but to date, it's an also-ran, according to data released by local media and advertising research firm Borrell.

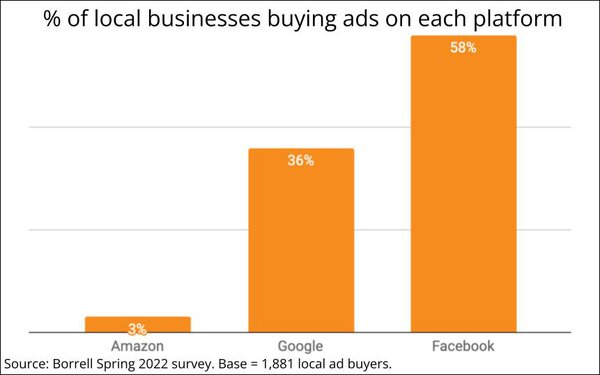

The data, derived from Borrell's survey of 1,881 local

ad buyers conducted earlier this year, found only 3% currently buy local advertising on Amazon, a fraction of the local ad buyers who say they currently place ads on Google (36%) and Facebook

(58%).

The findings also help explain why Facebook has been so aggressive in its small business lobbying campaign against Apple for its App Tracking Transparency framework, which Facebook has

claimed hurts small business advertisers on its platform.

The study also shows that Amazon has a tremendous opportunity to expand its local advertising share. According to stats released late

last year by eMarketer, Amazon currently has about a 15% share of total digital ad spending (including both national and local advertisers) vs. 24% for Facebook and 26% for Google.

advertisement

advertisement

And based

on the Big 3 digital ad platforms' second quarter earnings reports, Amazon's share is expanding the fastest, with total ad sales expanding 18% vs. the second quarter of 2021. Google's ad sales grew

12% and Facebook's rose only 1.5% during the same period.

And while Amazon has much smaller share of local ad spending overall, it also has significant upside in terms of the average rate of

ad spending by local advertisers (see chart below).