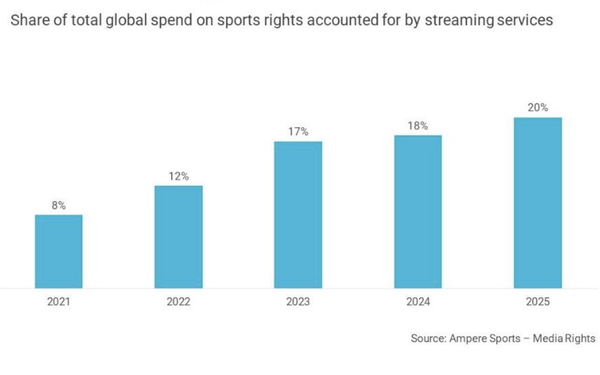

Global streaming platforms are gaining on

acquiring sports rights -- now up to 20% of all global TV deal-marketing at $12.5 billion, according to Ampere Analysis.

Netflix and Amazon had a lot to do with this -- Netflix with some key

Christmas Day exclusive NFL games and Amazon with a new NBA deal, now boosting its sports visibility adding to the NFL “Thursday Night Football” package of a couple of years ago.

The biggest spender is the London-based DAZN -- which has a 33% share, according to Ampere Analysis, which made a $1 billion deal for the 2025 FIFA Club World Cup event this summer. It has major

sports rights that extend all over Europe --- Germany, Italy, Spain, and most recently France.

Amazon Prime Video is next in terms of global streaming sports share -- with 23%, followed by

YouTube TV at 18% and Netflix at 5%.

advertisement

advertisement

Sports is pretty much the last stop for legacy, linear TV networks -- with many analysts believing they will help keep legacy TV platforms alive, all

because of high viewership.

Other live TV content -- especially news -- is now closer to making a more dramatic shift to streaming perhaps more quickly than sports, especially some TV news

networks -- MSNBC and CNN due to less-than-stellar linear TV viewership.

In addition, all major 24/7 news channels are all toying with moving more TV news content to streamers.

At that

same time, we see big NFL games are being simulcast on streaming platforms (Peacock, ESPN+, Paramount+) or aired exclusively on streamers (Peacock, and Prime Video).

Some analysis suggests

this could lead to greater fragmentation of the TV-streaming ecosystem -- and this might not benefit consumers. Cord-cutting could accelerate beyond its 10% per year, which has been the pace of this

churn for the last few years.

But legacy TV network companies have to be slow and vigilant when making transitions. They have yet to see the same profit returns on streaming -- especially when

they continue to see higher costs in the coming years.

In the meantime, consumers will become more choosy in what content they truly want to see.

Why? It goes back to the original

complaint about pay legacy TV packages: Too many networks.

Research has shown that on average, traditional pay TV viewers -- cable, satellite, telco customers -- only watch at most around 6-10

networks, out of 200 or so networks that consumers do not regularly view.

Legacy TV companies are aware of this, which is why they are trying to find new ways to bundle content.

Growth

of sports on streamers will only drive a bigger wedge into the TV-streaming business. More disruption is coming for those that want to play ball.