The future of mobile payments may have just received a boost from

Walmart.

The future of mobile payments may have just received a boost from

Walmart.

The massive retailer this week notified the world that it’s introducing a chip-enabled Walmart MasterCard to increase security.

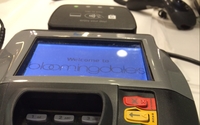

Unlike traditional magnetic strip credit

cards, common in the U.S., chip-enabled cards are inserted into a payment terminal for the chip to be read. And that’s where mobile payments may get a lift.

With a traditional mag swipe

card, payment is relatively instant. One quick swipe and done.

That’s been one of the most-stated obstacles to mobile payments: it’s just as easy or easier to pay with a credit

card rather than pulling out a phone, loading a payment app and tapping.

The EMV chip technology is now popping up in stores everywhere, even if not yet activated. I’ve seen them in

Macy’s, Bloomingdale’s and Verizon, to name a few. The employees working there typically are unaware, since the hardware has to be deployed at a massive scale before being turned on.

advertisement

advertisement

In other countries, EMV technology has been in use for a long time, often referred to chip and pin, since you use the chip in the card and then enter a PIN code.

In the U.S., the typical

payment terminal conversions are to chip-enabled cards followed by a signature. And that’s the catch.

The chip reading is not as instant as a quick swipe. For example, at the end of a

lengthy taxi ride in Paris recently, I handed over my chip-enabled card, the driver inserted it into his terminal and I waited. And waited. And waited.

This is going to require new consumer

behavior, most often the biggest stumbling block to mobile advancements. However, because of the scale of Walmart, the behaviors of millions of consumers will be modified over time.

Shoppers

are about to be re-trained from swiping a credit card to inserting it. And waiting. Even if a short time, it’s a change in behavior.

To nudge its customers to modify their payment

behavior, Walmart MasterCard holders receive cash-back rewards and gas discounts for a time.

Convincing a mobile shopper to reach for their phone rather than a quick-swipe credit card has been

challenging, to say the least.

Walmart and others are on the verge of setting up a scenario where tapping a phone may suddenly look easier to make a payment.