It looks like the long-awaited, retailer-backed mobile

payments program may be finally launching.

It looks like the long-awaited, retailer-backed mobile

payments program may be finally launching.

Well, at least in a limited test run starting next month, according to a published report.

The mega retailer consortium Merchant Customer

Exchange (MCX), whose member merchants represent more than a fifth of U.S. annual retail sales, has been employee tested and is now ready for field trial, according to a report in Bloomberg.

An advantage of the payment system known as CurrentC, at least as initially devised, is that it doesn’t require any hardware upgrade at the stores, as I wrote about here last year (Mobile Payments & the Battle of 2 Ways to Pay).

If deployed at all the

participating MCX member locations, the issue of merchant acceptability of mobile payments would essentially vanish.

advertisement

advertisement

And it’s not like there aren’t major players involved across

the board in MCX.

Here are just some of the participants in the merchant mobile payment venture:

- Retail – Walmart, Target, Best Buy, 7-Eleven,

Dick’s Sporting Goods, Kohl’s, Old Navy, Sam’s Club, Banana Republic, Sears, CVS, Dillard’s, Gap, Kmart, Lowe’s, Target, Rite Aid and Bed Bath & Beyond

- Gas Stations -- Sunoco, Exxon Mobile, 76, Shell, Phillips 66

- Supermarkets -- Publix, Giant Eagle, ShopRite, Meijer,

- Eateries --

Dunkin’ Donuts, Wendy’s, Baskin Robbins, Olive Garden

But all sailing has not been smooth for MCX.

Earlier this year, the CEO of the group left “to

pursue other opportunities.”

Around the same time, Best Buy announced that it planned to accept Apple Pay, in a break from the exclusive mobile payment arrangement with other MCX

members.

That followed a similar announcement by grocery chain Meijer that it would continue to accept mobile payments from others outside of MCX, as I wrote about here (Mega-Mobile Payments Venture Loses Leader; Best Buy Moves to Apple Pay).

And then PayPal acquired Paydiant back in March, (PayPal Buying the Quiet Mobile

Payments Company). Boston-based Paydiant created the tech engine behind MCX payments.

The exclusive retailer arrangements at MCX are soon to expire, which could open the door very widely

for other payment options, such as Apple Pay, Android Pay and Samsung Pay.

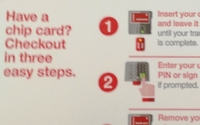

In addition, major retailers all are getting ready to move to what are known as chip & pin or chip & sign

credit card transactions. Rather than a credit card swipe, consumers will insert their card into the point of sale terminal for the chip on the card to be read.

The obvious question is how

much consumer behavior around how they pay can be changed.

At least consumers will finally see what MCX has been working on these past few years.

And they will ultimately determine if

it was worth it.