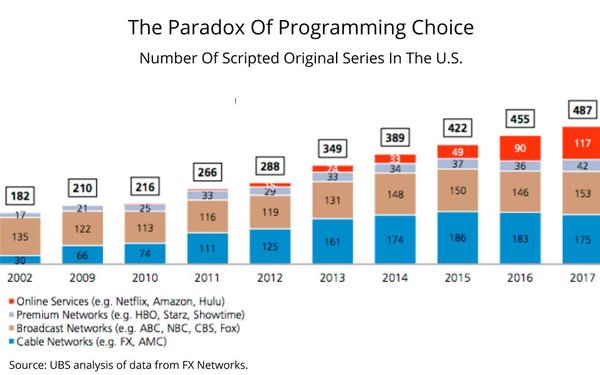

It’s been a quarter century since cable TV

pioneer John Malone coined the concept of a “500-channel universe,” sparking advertising and media industry debate about the implications for the hyper-fragmentation of the world's

greatest and most effective mass medium. Twenty-five years later, the “television” universe has exploded into streams of …

Reminder: You are seeing this premium content because you are a subscriber to MediaPost's Research Intelligencer and/or a member of the Center for Marketing & Media Research. This content cannot be viewed by non-subscribers/non-members.