U.S. political ad spending is so significant that for years the

major ad forecasters have either published two versions of estimates including and excluding the impact of U.S. ad spending in their worldwide calculations, or left it out entirely. They have done

this because the cyclical nature of quadrennial presidential election years skew the picture of underlying growth of the underlying ad economy.

Never mind that even off-year political spending

has grown significant in the U.S. due to ongoing political issues advertising bought to sway public or legislative opinions, many ad industry economists and political media consultants have simply

taken it for granted that the U.S. is the world's biggest political advertising market. Well it is, and it isn't according to a unique new analysis included in GroupM's just-released mid-year update

to its annual advertising forecast.

advertisement

advertisement

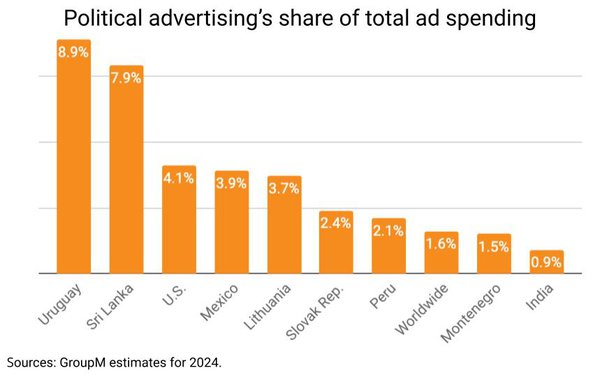

Yes, the U.S. remains far and away the biggest political ad economy in terms of volume, but in terms of share of overall ad spending, GroupM found other

markets actually allocate more to political campaigns.

While GroupM did not tease out political ad spending for every ad market it calculates, it found at least two -- Uruguay and Sri Lanka --

actually spend more on political advertising as a percentage of their overall ad economies. Others, including Mexico and Lithuania aren't far behind the U.S. in terms of share of total ad

spending.

On reason GroupM did the analysis was to understand the degree with which political ad buys disrupt the supply of ad inventory for domestic advertisers in other markets.

"I

think we can start to see that this is not just about U.S. political advertising, but much more broadly about political advertising globally, GroupM Global President of Business Intelligence Kate

Scott-Dawkins said during a press briefing in advance of its just-released mid-year update.

She cited the impact of tight political advertising markets in some "African nations," where regular

consumer marketing brands were forced to move their schedules to the second half of the year, because the first half was so dominated by election advertising and media coverage.

In fact,

Scott-Dawkins said GroupM is considering creating a separate line item in its domestic forecasts for other markets similar to the way it does it for the U.S. in order to get a handle on the impact the

category has on the underlying ad economy.