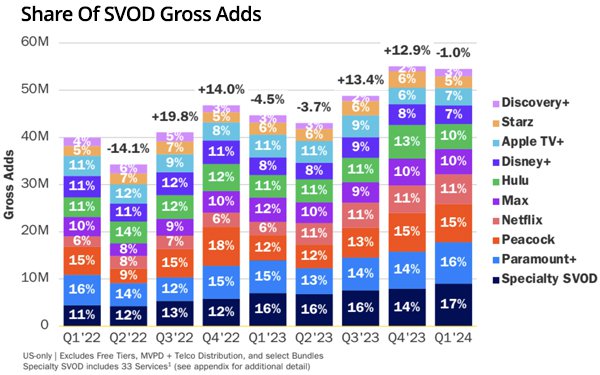

The growth of premium video subscription streaming platforms

slowed down in the first quarter of this year -- rising 10.2% year-over-year (25.8 million net additions) to 275 million U.S. subscriptions, according to estimates from Antenna.

In 2023, premium

subscriptions gained 19% year-over year.

Netflix had the strongest growth at 7.3 million -- largely due to its crackdown on password sharing and the launch of its ad-supported tier, which

started up in the fourth quarter of 2022.

The subscription researcher says that in terms of percentage gains, Peacock witnessed its biggest spike -- up 31% -- with 8.1 million gross additions.

Paramount+ also pulled in a high level of gross subscribers at 8.8 million. Both were driven by NFL post-season games -- the AFC Wild Card game (Peacock) and the Super Bowl (Paramount+).

The closely watched "churn" rate -- the net result of gross subscribers versus those who end their subscription -- inched up to 5% (in March 2023) from 4.4% (March 2024).

advertisement

advertisement

It notes Warner Bros. Discovery’s Max made the biggest improvement down to 6.3% from 7.3%. Netflix remained the strongest overall -- with a 1.9% churn rate.

New

advertising-supported options from Netflix, Disney+, and others comprised 38% of overall streaming subscriptions growth in the first quarter, representing more than 50% of the gross subscriber gains

in the period.

On a quarterly basis -- the first quarter of 2024 versus the fourth quarter of 2023 -- net subscribers additions fell "significantly" to 4.8 million.

Previous

quarterly periods witnessed net gains between 7 million and 8 million.

“Video streaming is reaching a new level of maturity. Growth is more moderate, and churn continues to be

a challenge,” write the authors of the report.

“With their brands now well-established and with strong foundations of scale, SVODs [subscription video on demand

platforms] have shifted their focus from pure subscriber acquisition to a more nuanced attention on profitable growth.”

Antenna gathers its data from a variety of

data-collection partners that contribute millions of permission-based, consumer opt-in, raw transaction records. Data is derived from digital purchase and cancellation receipts, consumer

subscription signals, credit, debit and banking data.