As was widely reported at the time,

streaming’s share of TV viewing surpassed those of cable and broadcast last July — reaching nearly 35%. That has since climbed to about 38%.

But that’s not necessarily

reassuring for paid, subscription-based video-on-demand (SVOD) ad-supported streamers.

As Bloomberg recently pointed out, combined new subscriptions for Netflix, Disney and Paramount

declined from 105 million in 2020 to 79 million in 2021 to 62 million last year. And many tracking studies and surveys have indicated, ad-supported streamers account for a growing portion of

streaming.

Deloitte’s newly released 2023 Digital Media Trends report underscores those trends, and also documents Millennials’ crucial part in them.

According

to the report, based on a census-balanced survey of 2,020 U.S. consumers age 14 and over in November 2022, about half (47%) say they have made a change to their entertainment subscriptions because of

current economic conditions, such as cancelling a service to save money, switching to a free ad-supported version of a service, or bundling services.

About 60% of households are now

using a free, ad-supported streaming video service (FAST), and roughly four in 10 say they are watching more ad-supported streaming video than they did a year ago, whether FAST or AVOD (ad-supported,

lower-cost tiers of paid services. In a separate report, Deloitte predicted that by the end of 2023, nearly two thirds of consumers in developed countries will have at least one subscription to an

ad-supported video service.

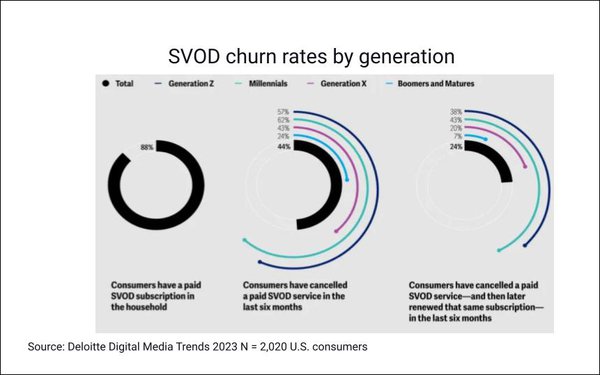

Nearly half of consumers say they pay too much for SVODs, and about a third say they intend to reduce the number they subscribe to. Reported overall

subscriber churn for SVOD services over a six-month period was 44%, but among Gen Zs and Millennials, the rates were 57% and 62%, respectively.

About a quarter of consumers report

having “churned and returned” — cancelling a paid SVOD subscription, then reupping it within a six-month period. But that behavior also jumps by double digits among Gen Zs and

Millennials, who often subscribe just to see the new season of a show or a new movie, then cancel. (Chart top of page.)

“Millennials drove the adoption of SVOD but may now illustrate the

impacts of subscription fatigue and cost-sensitivity,” Deloitte observes. “The oldest among them turn 40 this year, and many may now have children, mortgages, and other financial

obligations — including record household debt.”

Millennials spend more than any other generation on paid streaming video services — an average of $54 per month —

but they also churn through SVOD services at the highest rates (and are also more likely to cancel paid gaming and paid music services).

“Streaming media providers might hope that cheaper ad-supported

options could retain these cost-conscious consumers, but Millennial behaviors and preferences tend to skew closer to Gen Z’s,” the report points out. “Will they put up with

subscriptions and traditional advertising? Or will they shift to spending more time and less money on other digital media?”

Gaming’s exploding popularity among nearly all ages, and

particularly younger generations, has been well documented. But user-generated video content is also a major alternative.

As Millennials appear to reach their SVOD limit, “social

media services are happy to serve their video needs” with UGC, the report notes. “Half of Gen Zs and Millennials prefer user-generated video feeds to streaming video services. Across all

generations, a majority say they watch user-generated videos—because they’re free to watch, videos they see are about topics they’re interested in, they’re convenient to watch,

and there’s always something new. Like TV (streaming or otherwise), top social media services now offer a more passive video experience. Unlike TV, they deliver endless streams of shorter,

user-generated videos that are personalized, interactive, and social, at no cost.

The report is free online.