There’s a lot to navigate right

now as a CPG brand marketer.

CPG Insider caught up with Dan Buckstaff, CMO of wellness-focused data technology company SPINS, to get a take on how evolving trends are shaping the CPG

space, and what anxieties are top of mind for CPG brands right now.

This interview has been edited for length and clarity.

CPG Insider: What are the biggest

challenges CPG brands are facing right now?

SPINS CMO Dan Buckstaff: There’s an overhang of uncertainty around inflation, price increases for materials, supply and input cost

increases, and shortages. A lot of issues were built up over the last two years for those things.

Some of the most innovative brands didn’t take the same level of price increases as more

conventional brands and as a result of that they have a little catch-up to do. But the world is changing and the rate of inflation is declining, so large retailers are pushing back hard on that.

advertisement

advertisement

The other thing we’re seeing is rapidly changing consumer preferences around products -- the values they want to see expressed, around sustainability or health, or other issues. Innovating to

be able to keep up with that is difficult, because the rate of change is accelerating.

Products, or even whole categories, that were hot three or four years ago are suddenly not so hot

anymore. There have always been consumer shifts, but newer generations of shoppers are expressing their values more vehemently as they shop. Trying to stay ahead of that innovation is another area of

significant anxiety for brands.

What are some of those categories that have seen particularly dramatic shifts?

One is sunscreens. The sustainability and health aspects of

certain types of sunscreen that are more chemically based are losing share rapidly to mineral-based sunscreens -- which have better sustainability profiles, and don’t sink into your skin the

same way as chemically based sunscreens. Due to a combination of such factors, there are radical marketshare shifts in that category.

It’s hard for the product innovation pipeline to

keep up with that unless you see these trends coming a long way away.

What are you seeing from brands trying to stay ahead?

Brands are increasingly trying to identify where

innovation emerges, where these trends first show up. Sometimes restaurant menus will show early trends in terms of diet. Sometimes it emerges in smaller, independent, health-oriented grocery

retail.

You’re seeing CPG brands going out into the world and trying to find these things. And they do a lot of experimentation; they create products, they do testing, and they see what

the winners are.

The other challenge is trying to understand what consumer preferences are driving emerging products. You have to do a deep dive on what that product is actually about, what

attributes of the product people care about, and what adjacent trends are swirling around a particular category.

Why do you think these consumer trends are shifting so rapidly?

Millennials and younger generations are much more mindful of the impact their behaviors have on the world, the environment and other people. That concern is being expressed in how they live and the

choices they are making, and that flows into what they buy.

Values-oriented consumers are less price-sensitive on products where they can shop their values, compared to other products.

They’ll tolerate some price increases and price differentials if their perceived values are expressed by the product.

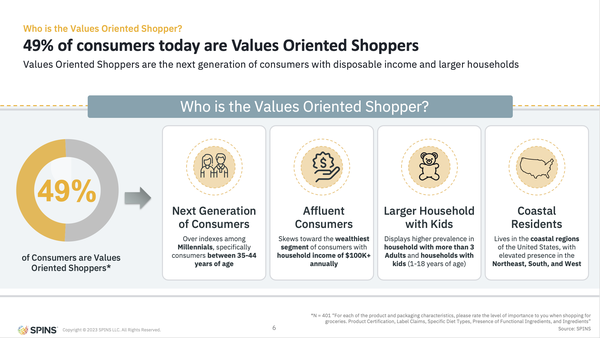

Almost 50% of all consumers are shopping their values in at least

one category. That can be a health concern, like avoiding gluten or sugar, or it can be things like sustainability. It’s not that people are either values-oriented shoppers or not. It gets very

specific to categories and needs.

Are there specific sets of values they’re more likely to prioritize?

In our research, we found that sustainability tends to be the value

the most people are trying to express. It also tends to be trickiest. There’s a lot of greenwashing. It’s very difficult to capture the full impact of a particular product. There’s a

lot of work being done, by a lot of parties, to try to provide more transparency.

What most sets the current moment apart from the past couple of years?

We’re at a moment

of significant change, almost a tipping point where all of this innovation we’re seeing is beginning to reach mainstream channels. There’s a massive opportunity for innovative CPG brands

meeting emerging consumer needs. But it’s tricky, too, because it means a fragmentation of the mass market. It means more products. How do you connect people and their values with the

products and innovation they’re looking for? That’s a challenge that spans the whole ecosystem.