Google's investment in a Taiwanese semiconductor subsidiary will give the company a 6.3% interest in Himax Technologies, with an option to make an additional investment of preferred shares in the

manufacturer at the same price within one year from closing.

Google's investment in a Taiwanese semiconductor subsidiary will give the company a 6.3% interest in Himax Technologies, with an option to make an additional investment of preferred shares in the

manufacturer at the same price within one year from closing.

Having the ability to contribute to the design of chips could influence the future of online advertising through hardware, rather than Web-based systems.

If Google takes full

advantage of all options, that share could rise to as high as 14.8%. The Mountain View, Calif. company joins KPCB Holdings, Khosla Ventures, and Intel Capital as the core group of shareholders.

Himax, a fabless semiconductor manufacturer employing about 1,400, designs but outsources the manufacturing of chips for use in televisions, laptops, monitors, mobile phones, tablets, digital

cameras, and other consumer electronic devices. Google's investment in the company would ensure continuous access to components to build its products, even in shortages.

advertisement

advertisement

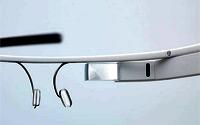

The investment will

fund production upgrades, expand capacity and enhance production capabilities at the manufacturer's facilities that produce liquid crystal on silicon (LCOS) chips and modules used in applications

including head-mounted display such as Google Glass, head-up display and pico-projector products.

Google has been working with Himax Display to manufacture parts for Project Glass, according

to a source. It's likely the two companies will work together to design software on chips for other devices. Himax's long list of open job requisitions includes a process integration engineer for its

advanced optronics research and development center.

"Himax Display has been a great partner for several years now," said a Google spokesperson. "This investment is an extension of our

partnership, which we hope will allow the team to continue to develop their operations."

The Taiwanese semiconductor manufacturer posted a 5.4% increase of revenue to $175.7 million in the

first quarter of 2013. Non-GAAP net income rose 23.6% to $15 million from $12.1 million, compared with the year-ago quarter.

A breakdown of the company's financial results by product line

demonstrates strength in display drivers for small and medium-sized panels for electronic devices for gadgets like tablets, Chromebook, smartphones and Google Glass.