With uncertainties growing about the future health

of the economy, nearly 30% of the world’s biggest advertisers are planning to cut ad budgets in 2023, according to a new survey from the World Federation of Advertisers (WFA) and Ebiquity.

About the same percentage said they planned to increase budgets while the rest of the respondents, around 40%, indicated that their budgets will remain flat next year versus 2022.

The study

is based on a survey of 43 multinational companies. The sample included five of the world’s top 10 advertisers by spend, which collectively invest more than $44 billion in

advertising.

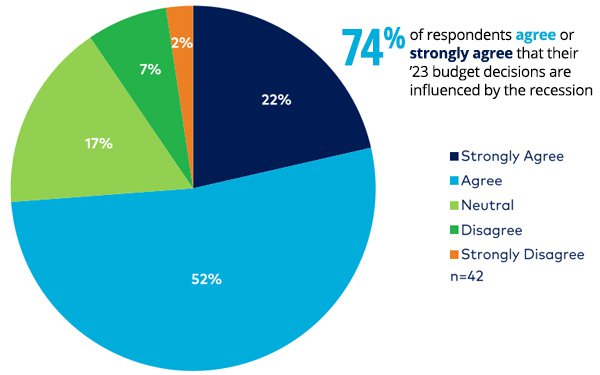

Three-quarters of those polled said that budgets are under “heavy scrutiny,” with marketers required to justify investment.

The study found some differences by

region. There is more evidence of a potential cut in spend in Europe Middle East and Africa compared with Asia Pacific. In EMEA, for example, a third of respondents agree there could be a significant

(more than 10%) or slight decrease (0-10%) next year, compared to 30% who are planning a slight increase in spend. By contrast, in APAC just 15% envision a slight decrease while 35% plan a slight

increase.

advertisement

advertisement

In North America a plurality of respondents—44%--indicated budgets would be flat at their companies next year. About a third envision an increase of up to 10% while 3% said

their firms were planning increases greater than 10%.

About 21% of North American respondents said their companies would cut their ad budgets. Nine percent are bracing for cuts of more than

10% and 12% believe the cuts will be less than 10%.

There will also be a further shift away from traditional/offline media to digital per the study. 42% said their outlays for digital will

increase, with offline media such as TV, radio, print, and outdoor likely to take a hit. Nearly half of respondents are planning to cut offline investment and a quarter are looking to make a

significant cut (of more than 10%) in print spend.

Twenty-eight per cent of respondents say they will seek to boost performance, compared to 21% who are focused on increased brand spend in

2023.

Greater flexibility is also being sought meaning greater use of biddable/auction-based platforms. This approach also allows brands to hold back funds, should economic conditions dictate.

Just 9% are planning to increase the proportion of budget allocated to upfront commitments, according to the survey.