Over-the-top (OTT) ad spending

accounted for 14.8% of a total $23.3 billion in digital ad spending in the U.S. in Q3 2022, to social media’s 61% and display/video’s 24%, according to data from Sensor Tower’s

Pathmatics.

In comparison, OTT claimed an average 13% share of total U.S. digital spend between October 2021 and January 2022, per an earlier Pathmatics report.

The data is

powered by a panel of OTT and connected TV viewers, and spans all smart TV brands.

Although the overall level of ad investment from consumer packaged goods (CPG) brands on TikTok and Snapchat

increased by more than 20% in Q3 versus Q2 2022 Q/Q, the category's spending on OTT was basically flat.

Despite this, CPG remained the No. 1 OTT spend category for the second straight quarter,

when it surpassed former No. 1 financial services.

advertisement

advertisement

In fact, all three top categories on OTT — including No. 3 health and wellness, remained the same as in Q3 as in Q2.

But

automotive dropped out of the top five, as its quarter-over-quarter OTT spend declined by 26%, from $285 million in Q1 to $209 million in Q3.

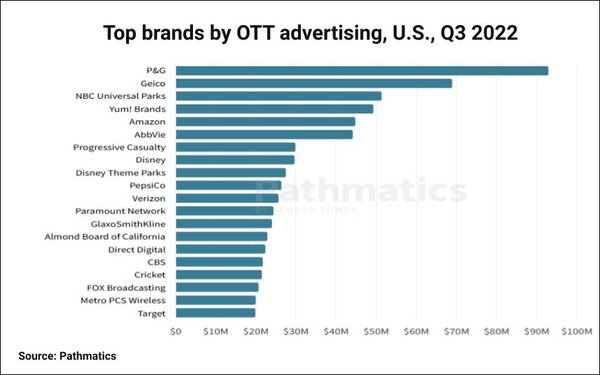

P&G and Geico — which held the top two OTT advertiser

spend positions in 2022’s first three quarters — were the only two advertisers to reach $60 million in OTT ad spend in the quarter.

NBC Universal Parks and Disney Theme Parks ramped up their OTT

investments during the summer season by 31%and 54% quarter-over-quarter, respectively.

Although Disney Theme Parks did not rank among the top 25 last quarter, this boost in ad spend moved it

up 17 positions to enter the top 10 in Q3.