Automotive estimated national TV spending in February

totaled $167.8 million in February compared to $504.9 million for the same period a year ago, down 66.8% year over year, per iSpot.tv.

The decline is due in part to fewer automotive brands

buying Super Bowl time this year compared to last year.

TV ad impressions were up 5.1% year over year to 23 billion in February 2023 compared to 21.8 billion in February 2022.

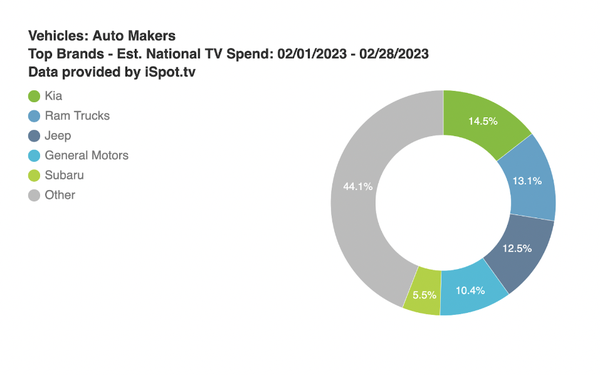

The top five brands by estimated national TV spend for the month were Kia ($24.3 million), Ram Trucks ($22 million), Jeep ($21 million), General Motors ($17.4 million) and Subaru ($9.2

million), per iSpot.tv.

The most-seen automaker ads in February were Nissan: Whodunnit (2.96%),

Buick: Quadruple Take (2.33%), Ram Trucks: What It Means To Be a Ram (2.10%), Nissan: Dualities (2.07%) and Lexus: Characters (1.91%).

advertisement

advertisement

Kia had an 88.2% increase in ad airings compared to February 2022 with a 13.4% year-over-year

increase in estimated national TV ad spend. The automaker upped its airings during sports, and in particular NHL games (+1100% increase in airings year-over-year), NBA games (+291% YoY) and

men’s college basketball (+126% YoY), per iSpot.tv.

Nearly 80% of General Motors’ estimated spend was on its Super Bowl LVII spot alone. Subaru was the only brand in the

top five that did not air an ad during Super Bowl LVII — but it did advertise during Puppy Bowl XIX and the 65th Annual Grammy Awards.

While the Super Bowl was a major

opportunity for automakers to reach a wide audience in February, the industry also found other ways to maximize TV advertising reach for the month, said Stuart Schwartzapfel, EVP, media partnerships

at iSpot.

“Year-over-year, morning news, drama and action shows delivered larger shares of auto brand TV ad impressions, as did NBA, NHL and men’s college

basketball,” Schwartzapfel says.

The top five brands by share of automaker TV ad impressions in February were Chevrolet (8.77%), Lexus (8.73%), Toyota (8.16%), Nissan

(7.84%) and Hyundai (6.82%).

The biggest estimated spending increases among the top 15 brands were Ram Trucks (+281.33%), Jeep (+176.98%), Honda (+163.27%), Volkswagen (+17.77%) and

Kia (+13.35%).

Much of the year-over-year increases in spend for both Ram Trucks and Jeep are due to a heavier investment in sports, and in particular the Super Bowl — both

brands aired ads during the Big Game this year, while last year they both aired ads during the pregame only.

For Ram Trucks, the sports genre (including sports commentary

programming) accounted for nearly 88% of the brand’s total outlay for February 2023, a year-over-year increase of 535% for the genre.

Meanwhile, Jeep had a 613%

year-over-year increase in estimated spend within the sports genre. Honda has also been betting big on sports, with a 67% year-over-year increase in estimated spend during NBA games and a 163%

increase in estimated outlay for NHL matches.

The top programs for automakers by share of TV ad impressions for February were men’s college basketball (5.38%), NBA

(3.87%), "Law & Order: Special Victims Unit" (1.86%), PGA Tour Golf (1.73%) and NFL football (1.58%).

"Law & Order: Special Victims Unit" had the largest year-over-year

increase in impressions among the top five — 160%. Additionally, NBA and men’s college basketball both saw year-over-year increases in impressions (43% and 20%, respectively), but not

nearly at the rate of a few other programs that didn’t make the top five.

Automakers received 286% more impressions during "Good Morning America" this month compared to

February 2022, while NHL games had a 230% year-over-year increase in impressions for the industry.

The top networks by share of automaker TV ad impressions for February were

ESPN (6.51%), CBS (5.75%), ABC (5.70%), Fox (4.72%) and NBC (4.06%).

Year-over-year automaker impression increases across SportsCenter, men’s college basketball and NBA games

have driven ESPN to the top of the network ranking; Overall the network had a 50% increase in industry impressions compared to February 2022.