Automakers spent nearly the same on national TV

spending in April than they did a year ago, per iSpot.tv.

Estimated spending for April 2023 was $200.7 million, which is down only slightly from the $200.8 million

spent in April 2022.

April 2023 household TV ad impressions registers at 26.4 billion, up 5.7% from 25 billion in April 2022.

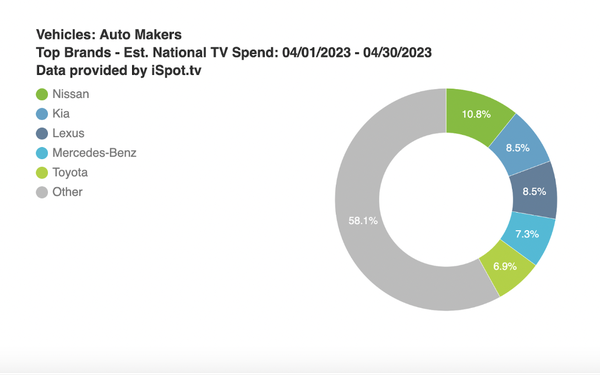

The top five brands were

Nissan ($21.7 million), Kia ($17.1 million), Lexus ($17 million), Mercedes-Benz ($14.6 million) and Toyota ($13.8 million).

The most-seen automaker ads by share of household TV ad

impressions for the month were Dodge: Swarming the Nation (3.18%), Ram Trucks: To Be a Ram: Have Heart (3.10%), Chevrolet: Big Life (2.75%), Chevrolet: Choose Your Own Path (2.40%) and Subaru: Dog Tested: Soccer Practice (2.17%).

advertisement

advertisement

Nissan increased its investment in

NBA games by 65% year-over-year, while decreasing its men’s college basketball outlay by 26%. Kia also put a focus on MLB — it did not spend during games at all in April 2022, while this

year MLB was the No. 5 program by outlay for the brand.

Meanwhile, Lexus went bigger with the NHL and the NBA, with year-over-year spend increases of 354% and 255%,

respectively. For Mercedes-Benz, it was mostly about the 2023 Masters: 61% of its total estimated spend went to airings during the tournament, of which it has been a global sponsor for

years.

The top five brands by share of automaker household TV ad impressions for April 2023 were Lexus (9.48%), Toyota (9.35%), Hyundai (7.05%), Nissan (6.93%) and Chevrolet

(6.78%).

The biggest estimated spend increases among top 15 brands by spend for April 2023 vs. April 2022 were Honda (+244.0%), Dodge (+89.3%), Subaru (+45.4%), Lexus (+28.9%) and

Buick (+23.4%).

Sports and related programming were key drivers of Honda’s year-over-year estimated spend increase: It nearly tripled its investment in that genre, including

spending about $2.7 million during men’s college basketball, which it did not invest in at all in April 2022.

Dodge leaned into sports similarly, increasing its

investment during games and related sports coverage by 168% year-over-year. It also advertised during men’s college basketball, "The Voice" and the 2023 NFL Draft — three programs it did

not advertise during in April 2022 (The Voice wasn’t airing during April last year).

Speaking of "The Voice," Subaru was another automaker that took advantage of the

show this year — it led for estimated national TV ad spend for the automaker during the month. Subaru also leaned into "Today" and "Good Morning America" more than last year, increasing ad

airings and estimated spend for the morning news shows.

The top programs for automakers by share of household TV ad impressions for the month were NBA (7.83%), MLB (3.35%),

NHL (3.02%), men’s college basketball (2.38%) and SportsCenter (2.25%).

Per the usual for spring, sports programming was a huge driver of TV ad impressions for automakers, but

there were two key differences this April compared to a year ago.

Auto brands leaned into MLB and NHL games much more. This year, MLB was the No. 2 program by household ad

impressions share of voice vs. No. 14 last year, which had April play shortened by a lockout. NHL was in third place for impressions SOV this year (No. 33 last year), with a 556% year-over-year

increase in estimated TV ad spend.

“Another sports-heavy spring creates opportunities for automotive brands to reach large audiences across baseball, basketball, hockey, golf

and more,” said Stuart Schwartzapfel, executive vice president, media partnerships at iSpot.tv. “Despite automakers’ estimated national TV ad spend staying essentially flat

year-over-year in April, auto brands also increased investment in sports programming by 22%, signaling they continued to find major value in those events even with the associated cost.”

Top networks for automakers by share of household TV ad impressions for the month were CBS (7.62%), ESPN (7.30%), ABC (6.23%). TNT (5.42%) and NBC (4.45%).

CBS takes

first place for household TV ad impressions SOV thanks in part to men’s college basketball, which had a 31.19% SOV for automakers on the network, and the 2023 Masters Tournament (16.03% SOV).

ESPN’s year-over-year SOV growth (from 6.10% in April 2022 to 7.30% this year) was partially driven by a 393% increase in impressions from NHL games on the network.

ABC

grew its impressions share from 5.65% in April 2022 to 6.23% in April this year, with year-over-year impressions increases for NBA (25%) and "Good Morning America" (247%) leading the charge.

TNT, which saw its share of impressions grow to 5.42% this April from 4.01% in April 2022, also benefited from a hockey bump: Impressions from NHL games increased by 683% year-over-year.

NBC was the only network in the top five that had a year-over-year impressions SOV decrease (down to 4.45% this April from 6.53% in April 2022).