Collagen is the leading functional food ingredient

creating buzz among menopausal and perimenopausal women, according to research conducted by Brightfield Group over the first half of 2024. Bone broth, valerian root, chia seeds and creatine have also

grown in visibility in the past year, with vitamin D also “discussed often," the researcher says.

Brightfield, which defines functional foods as those “that go beyond basic

nutrition, with natural ingredients designed to offer specific health benefits,” based its results on a survey of 40,000 consumers and social listening to millions of social media conversations.

Six in 10 Americans are interested or have purchased a functional food or beverage in the past three months, according to the company's latest report, titled “Innovative Snacking:

Exploring the Functional Food Revolution.”

advertisement

advertisement

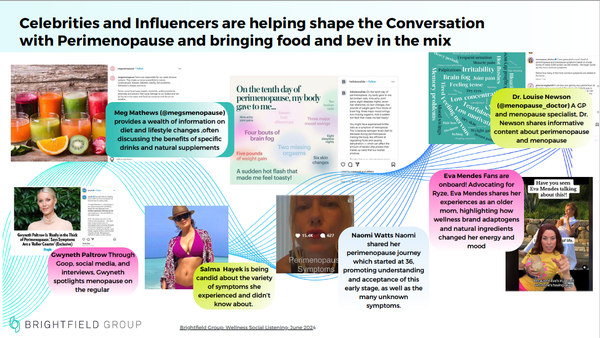

Stating that “talk of menopause and perimenopause is no longer taboo,” Brightfield says that social media conversations about those

subjects have been growing steadily since August 2023 and now represents 4% of conversations, “on a par with conversations about acne.”

Celebrities and influencers have helped to

bring food and beverages into perimenopause conversations, with the report citing Gwyneth Paltrow, Selma Hayek, Naomi Watts and Eva Mendez as examples.

Brightfield is also focusing on weight

management solutions like Novo Nordisk’s Ozempic and Wegovy, finding a 500% compound monthly growth rate this year in social media conversations about such GLP-1 drugs. This follows a cooling

off of such buzz over the last three quarters of 2023.

“As more people share their experiences and navigate weight loss journeys, the need for reliable information and supportive

communities will only grow,” the researcher says.

The number of people identifying themselves as overweight has increased 5.4% year-over-year since 2022 in its surveys, Brightfield adds,

with social media conversations about being overweight experiencing a “whopping” 50.1% growth in engagement.

Some 3% to 5% of survey respondents have been using GLP-1 injections

for weight management over the past year, the report continues, “a rate comparable to products like oat milk lattes and matcha tea!”

This rate has been slowing, Brightfield admits,

but “there are indications of another surge” by January, based on both social media interest and product innovation.

Those innovations extend beyond pharma to CPG products designed

to support GLP-1 users, with the report citing Nestlé’s launch of its Vital Pursuit high-protein frozen food line, Mondelez positioning its

snack bars as ideal for GLP-1 users, Daily Harvest offering GLP-1-user targeted meal kits, and Conagra exploring high-protein, low-calorie snack options like beef jerky and popcorn.