Advertising Age recently released its Top 200 ad spenders in 2014, noting that there’s a general shift toward

digital and pointing out that those top 200 spenders accounted for over half (51%) of U.S.-measured media ad-spending last year.

Advertising Age recently released its Top 200 ad spenders in 2014, noting that there’s a general shift toward

digital and pointing out that those top 200 spenders accounted for over half (51%) of U.S.-measured media ad-spending last year.

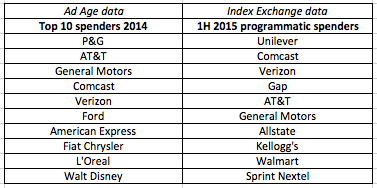

One thing sticks out: Advertising Age’s Top 10 list is

laden with companies that are leading the programmatic revolution as well.

Procter & Gamble was the No. 1 spender last year, per Ad Age’s list, and the company’s programmatic plans have been the subject of many conversations over the past year. The next four

largest spenders -- AT&T, General Motors, Comcast and Verizon -- are among the heaviest programmatic spenders so far this year, according to data from ad tech firm Index Exchange.

advertisement

advertisement

Per

Index Exchange data, during the first half of 2015, Unilever was the No. 1 programmatic spender, followed by Comcast and Verizon. AT&T and General Motors have been the fifth and sixth

highest-spenders in programmatic so far this year.

In other words, four of the five biggest spenders last year (inclusive of all advertising) have also been four of the top six programmatic

spenders so far this year.

Of course, when one of the largest companies in the world does something, it is unlikely they will do it small. The fact they are among the highest spenders in

programmatic is likely a consequence of them being the highest spenders in general, not the other way around.

But it is undeniable that the largest spenders in the U.S. are not shying away

from programmatic tech.

Verizon and Comcast in particular are going all-in on the tech. Verizon just spent over $4 billion to acquire AOL, and it apparently does not plan on stopping there. For its part, Comcast recently acquired Visible World, which owns programmatic TV platform

AudienceXpress.

Kellogg’s and Allstate -- along with Gap, Sprint and Unilever -- are on Index Exchange programmatic spenders list, but not Ad Age’s list.

“Unilever, Kellogg’s, and Allstate are three brands famously bullish on programmatic,” commented Lizzie Komar, Index Exchange’s new research head. “These

companies' media teams have made significant investment in programmatic over the past year. The [latter two] are openly closer to the in-house programmatic media management side of the programmatic

media management spectrum so it doesn’t surprise me that they’re spending significantly in our exchange.” (Unilever still does much of its programmatic business in conjunction with

Mindshare.)

Some players on Ad Age’s list that aren’t on Index Exchanges -- including American Express, Walt Disney and the aforementioned P&G -- aren’t sitting still

either. We’ve been over P&G’s activity in the space, but AmEx made waves last year as well when it set a theoretical goal of going 100%

programmatic, as first reported by Ad Age.

Additionally, Disney’s ESPN has been at the forefront of the programmatic TV revolution, with the sports network airing its first

programmatically-traded commercial earlier this year. ESPN is also working on its own data management platform (DMP).