With consumers growing ever more skeptical of virus-themed ads, Old

Navy may have a winner: Reminding people that “We stick together,” the company is donating $30 million in new clothing to needy families throughout the U.S.

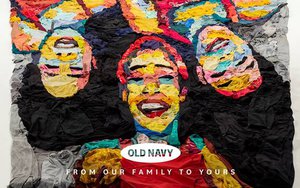

Teaming up with

nonprofits like Good360 and Baby2Baby, as well as transportation partner Penske Logistics, the company is introducing the gift with a video showing artist Noah Scalin turn 1,000 pieces of Old Navy duds into a 40-foot portrait of a woman with two

daughters, in keeping with the family theme of the ad’s music and copy.

Old Navy is also donating 50,000 non-medical reusable masks to longtime partner Boys & Girls Clubs

of America. Many of those clubhouses have remained open, providing a safe place for kids and families in underserved communities.

advertisement

advertisement

The effort illustrates how tricky it is for

brands to get their COVID-19 cause strategies right. They run risks: Give too little, and you’re invisible. Brag too much, consumers see you for what you are: a commercial entity trying to spin

compassion into sales.

“Taking action to help out in this crisis -- and letting people know about it -- is an extremely delicate task these days,” says David

Hessekiel, president, Engage for Good.

He tells Marketing Daily that gifts of $1 million, which in many cases would be the most useful to a nonprofit beneficiary,

“will be lost in a sea of similar releases.”

And while he doesn’t think the Old Navy effort is creative enough to go viral, “it is

enough to let stakeholders know that Old Navy is trying to thoughtfully help out.”

Companies that do nothing run another risk. The Cause Marketing Forum cites Harris Poll numbers that

show a full third of consumers think companies shouldn’t be advertising at all unless they’re taking some kind of action to help during the pandemic. And they’d like to see the help

flow in all directions, with 68% believing brands should be helping healthcare personnel, and 67% wanting companies to help those who have lost wages.

And what about the risks of

polarization, since with each passing day, that “we’re all in this together” sentiment seems to be waning?

Hessekiel isn’t worried. “I think the loud

angry protests are representative of a vocal minority and that the overwhelming majority of people realize the sensitivity of 'getting this right,'” he says. “It’s such a

fundamentally decent message that I don’t think there is much danger of the Gap or other companies being pilloried for embracing it.”

The Gap has been struggling with

declining sales, and called off its planned spin-off of Old Navy earlier this year. But the San Francisco-based company has sunk its teeth into the pandemic in a big way. It was one of the first

apparel brands to switch to making masks and other protective gear, for example.

And it has been one of the first retailers to publicly admit that many of its stores shut down for

COVID-19 concerns may not reopen.

“Meaningful change to the competitive landscape is inevitable in a time like this,” says Katrina O’Connell, its chief financial

officer, in a recent interview with Baird analysts. “Despite expectations for a recession, the surviving retail companies will be able to realize a larger share of what's likely to be a smaller

apparel market. We expect to be one of those survivors who will have leveraged our strong brands, our engaged customers, our advantaged online business and a smaller healthier fleet to emerge

positioned to gain share.”

Last week, the company announced that it signed licensing IMG as its “first ever multibrand, exclusive licensing representative.”

Plans call for IMG to focus on Gap, Banana Republic and Janie and Jack, exploring baby equipment and baby care, home décor, textiles and furniture.