The proportion of U.S. households with no television

set is no longer a rounding error: More than 5% now fall into that category, according to the Fall 2022 edition of the Advertising Research Foundation’s (ARF) Universe Study of Device and

Account Sharing (DASH) study.

That’s not because these households are off the grid. Instead, 80% have broadband, and more than 50% watch on various non-TV-set devices, according to

the nationally projectable syndicated study, used by media and measurement providers to estimate universes, correct for biases and gaps in big data sets, and assign viewership, devices and accounts to

households and individuals.

The TV set-less trend is being driven by young adults (18-34) in one-person households, who are twice as likely as older viewers not to own a television.

Reception mode follows suit: 50% of TV set-less households are digital-only/streaming, compared to just 14% of households with TV sets.

advertisement

advertisement

In addition,DASH data shows

that broadband-only (BBO) grew from 25% in summer 2021 to 30% in spring 2022 among TV-accessible households, including those without a TV set. The corresponding BBO penetration figures in TV set

households were 22% and 26%. Over the same period, pay TV households declined from 61% to 57%.

The study also confirms that virtual multichannel video programming distributors

(vMVPDs) are helping to fill the pay-TV gap.

BBO households can get linear television through vMVPDs such as YouTube TV and Hulu + Live, “so many in the industry want the rating services

to treat vMVPDs as just another form of pay TV, like cable, satellite and fiber services,” note the researchers. “DASH data shows that adding vMVPDs would raise the pay-TV universe to 67%

and lower BBO to 20% among all TV-accessible households. Some in the industry represent this 20% to be the entire BBO universe, while others include households with vMVPDs in BBO.”

Consumers’ use of multiple TV brands — or what ARF calls lack of TV brand loyalty — creates another measurement challenge.

“Many of the new currencies use Vizio

[ACR] data, but projecting household viewing based on usage of Vizio smart TVs will not produce a complete picture, as 86% of households with one Vizio TV have other TVs from other brands,”

points out the analysis. “Even in households with two Vizio TVs, other brands of TVs are present in 70% of cases. To make matters worse, not all the TVs in a smart-TV household are

smart.”

Further complicating the metrics

challenge, TV sets increasingly are “unequal access,” points out the report.

Only 21% of pay-TV households have a set-top box on every TV. The rest have at least one

TV that accesses a different programming menu. For example, a third of pay TV households have broadband connected to at least one TV, and 5% have an antenna on at least one set. Nearly half of the

pay-TV households with broadband (14% of 33%) have YouTube TV on at least one television, which gives those households access to two modes of linear viewing.

The report also includes

performance data on major subscription streaming services, with comparisons to last year’s results.

The household penetration levels of the major subscription streaming services

held mostly flat year-over-year, with the exception of Paramount+, which jumped up to 17% from 11%, driven by “Yellowstone.”

Disney+’s penetration edged up from 39% to 41%

and HBO Max’s from 27% to 29%. But the market leaders, Netflix and Amazon Prime Video, both saw declines: Netflix down to 66% from 69%, and Prime Video down from 58% to 56%.

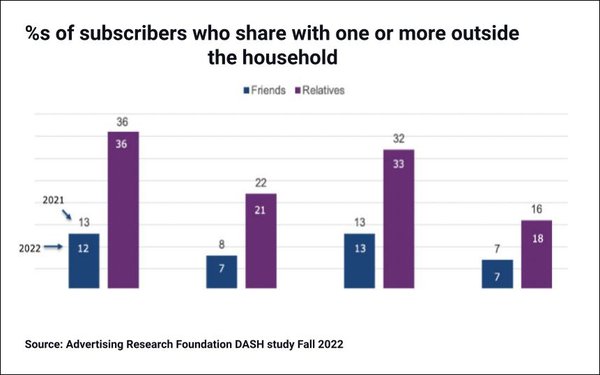

Netflix and

Disney+ remain the most shared services among both friends (12% and 13%, respectively) and relatives (36% and 33%, respectively).

Fielded in partnership with the NORC polling firm at the University of

Chicago, DASH is designed to serve as an industry standard for insight and data calibration. It is supported by multiple licensees, many of them competitors. Pooling resources enables a study that is

higher in quality and more widely acceptable than any conducted individually, according to ARF. After launching in 2021, DASH was renewed in 2022 and established as an annual study. ARF says it plans

to pursue MRC accreditation for the study.