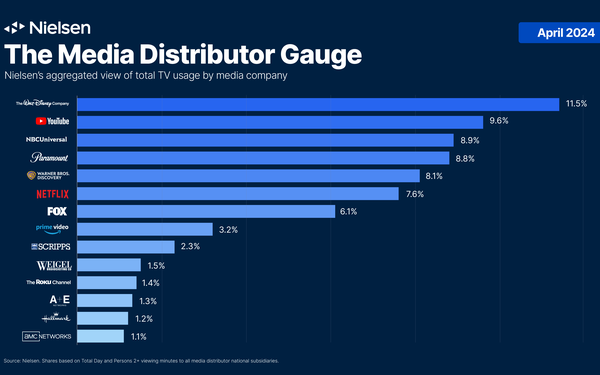

Nielsen's effort to show a complete picture with its new

“Media Distributor Gauge” totals all viewing from all platforms -- streaming, linear and otherwise for media companies. But some elements seem to be out of the frame.

Walt Disney -- which includes its ABC Television Network ESP, as well as streaming platforms Disney+, Hulu, and ESPN+ -- comes out on top when totaling up all viewing minutes over the

last six months, an 11.5% share.

YouTube comes in second (9.6%), followed by NBCUniversal (8.9%), Paramount (8.8%) and Warner Bros. Discovery (8.1%).

But you may wonder where Netflix is. The presumed premium streaming video leader is right behind the big four legacy media companies and YouTube -- in fifth place with a 7.6%

share.

In a way, this measure takes apart Nielsen’s other new total TV measurement “The Gauge,” which analyzes TV via its different significant

“channels” -- streaming, broadcast and cable.

advertisement

advertisement

The question, course, is whether the big legacy media companies can maintain their total TV usage status in

terms of monetization -- advertising and/or subscription fees from their broad TV-video businesses.

We all know the direction where linear TV is going. The

question is whether it can put all that legacy TV usage and business into their premium platforms -- perhaps with a boost from higher-priced advanced advertising price points linked to its media

plans.

This all makes sense when it comes to the upcoming TV upfront advertising market. And in particular it gave Rita Ferro, president of global advertising at Walt

Disney, something to crow about in the early minutes of Disney’s upfront presentation this week.

And there is good news: legacy media companies including Disney,

NBCU, Paramount Global, Warner Bros. Discovery already sell their advertising this way in massive inventory and placement packaging on linear, streaming, and perhaps other digital

platforms.

But are we missing some granular information for brands? That's important for those with a strong interest in legacy over-the-air television, especially local

TV stations.

Steve Lanzano, CEO and president of local TV station-focused advertising trade group TVB, said this week: “The [Media Distributors] Gauge

reports combine all video platforms in one analysis -- without separating ad-supported viewing from non-ad supported viewing -- which misleads marketers into thinking their commercials can reach

significantly more streaming viewers than is possible or the reality.”

Yes, it’s an overview. And perhaps not a basis for a media plan for specific

brands.

And just to be fair, we don’t have a full picture of Amazon Prime Video, for example -- which can be sold with Fire TV Channels, FreeVee (the

long-form FAST Network), Amazon devices (Echo) or as part of Amazon's broader retail media network.

It’s not ideal.

And where

the rubber really meets the road is when Nielsen “Media Distributors Gauge” offers up month-to-month changes in how big media is doing with that transition -- or not.