Although streaming video subscriptions

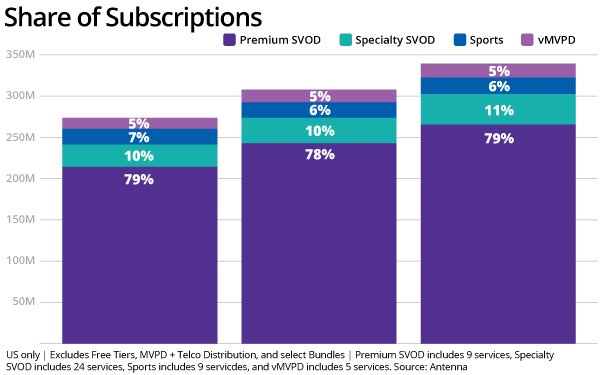

have slowed down a bit, they continue to see growth in the second quarter of 2025 -- adding 10% to now total 339 million, according to subscription research company Antenna.

At the same time,

"unique" individual streaming consumers for those connected TV apps (CTV) are up 8% to 177 million versus a year ago.

Premium streaming apps -- like Apple TV+, Disney+, Netflix, Hulu,

Paramount+ and Peacock -- now command a 79% share (267.8 million) of the total 339 million subscriptions-- up from 78% in the year-ago quarter.

Specialty streaming -- such as A&E Crime

Central, Hallmark+, BET+, BritBox, MGM+, Crunchyroll, Shudder, ViX Premium and Lifetime Movie Club and CuriosityStream -- added 12% (40.7 million) during the period.

On the losing end is

sports streaming, which has slipped 1% to 20.3 million. This includes DAZN, ESPN+, FanDuel Sports Network, MLB TV, MLS Season Pass, NBA League Pass, NFL+, NFL Sunday Ticket -- and UFC Fight Pass.

advertisement

advertisement

Virtual multichannel video program distributors (vMVPD) grew 5% to 16.95 million (a 5% share), according to Antenna.

All non-premium streaming categories were up 6% in subscriptions to 89

million in the period.

Good news for streamers is that consumers cancelling their subscriptions are down slightly. Premium streamers have the lowest/best "churn" rate -- at 4.1%. This includes

DirecTV Stream, Hulu + Live TV, Philo, Sling TV, and YouTube TV.

Specialty streamers have the highest/worst churn rate at 6.6%, while sports comes in at 5.1% and virtual multichannel video

program distribution (vMVPD) is at 4.5%.