Following some downward revisions

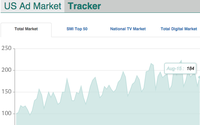

from major ad forecasters and syndicated ad-tracking firms, ad spending by Madison Avenue’s biggest players began to rebound in August, according to the latest findings from the U.S. Ad Market

Tracker, an index pooling actual media buys processed by the majority of major agency holding companies and their brand marketing clients.

Following some downward revisions

from major ad forecasters and syndicated ad-tracking firms, ad spending by Madison Avenue’s biggest players began to rebound in August, according to the latest findings from the U.S. Ad Market

Tracker, an index pooling actual media buys processed by the majority of major agency holding companies and their brand marketing clients.

The index rose 20 points to 184 in August

from 164 in July. More significantly, it is up 18 points year-over-year vs. August 2014, indicating that major U.S. brands and agencies are once again expanding their ad spending. While summer months

normally ebb in ad spending volume, budgets historically begin to flow again in August heading into the fall through holiday shopping season.

July, in fact, was only one point above

the 12-month low in terms of ad spending, which bottomed out in January with an index of 163. January typically experiences a cliff effect from December, which is normally the biggest advertising

month of the year. True to form, December 2014 was the 12-month peak with an index of 223.

advertisement

advertisement

The index, which developed jointly by MediaPost and Standard Media Index, aggregates data

from five of the six agency holding companies, and is considered indicative of general advertising trends. The index (below), which was set at 100 in January 2009, is interactive. Readers can scroll

over monthly plot points to reveal data values and can click on tabs in the headers to drill down into vertical media segments representing TV, digital and SMI’s Top 50 media company index.

Digital, not surprisingly, continues to be the most robust sector of the advertising marketplace, rising 29 points in August from July and 94 points from August 2014.

Within the broader digital category, some sub-types are performing better than others. Social (+87% in August vs. year ago levels) and video (+33%) continue to be the fastest-growing digital

segments, followed by Internet radio (+26%) and the programmatic exchange-based and ad network marketplace (+23%).

While pure-play Web content and search advertising continue to

expand (+16%), growth in the rest of the digital advertising marketplace is becoming more tepid. Some observers believe this is a function of programmatic exchanges and ad networks creating greater

price efficiency, which is drawing budgets from other media. But there also appears to be a flattening out within the most “commoditized” segments of digital media, particularly

conventional banner advertising as brands, agencies and trading desks focus on the most premium publishers and advertising formats -- especially video.

Print legacy digital

publishers were actually flat, and the expansion of the display advertising marketplace is approaching single-digit growth following years of rapid expansion.

While differing methodologies may be

part of the explanation, Kantar Media this week reported that the online display ad marketplace actually eroded 7% during the first half of 2015. The data from big agency holding companies is not so

severe for display, but it is beginning to moderate. In August, the display at market expanded only 13% over 2014 levels.