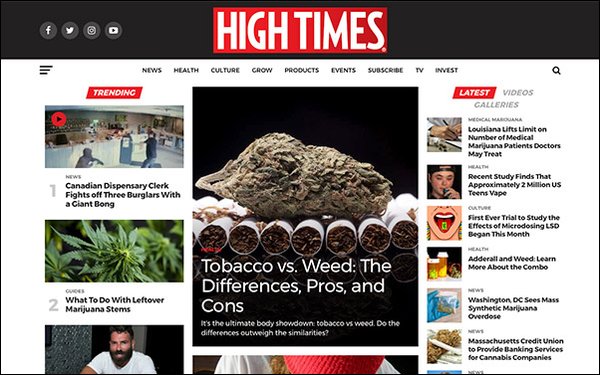

After making

initial moves to launch its IPO in June, High Times has announced that investors are backing the cannabis-focused content company.

High Times has cleared escrow

for $5 million from the SEC Regulation A+ filing.

“We have only recently started the process of offering our shares to the public, but to date, we have received support and

purchases from over 6,000 investors in our community,” stated Adam Levin, High Times CEO.

The company says it received backing from a large number of retail

investors the brand was looking to engage in June.

High Times took its first major steps to go public earlier this

summer with an “equity crowdfunding campaign” that allows investors to buy shares of the company at a discounted rate before it lists on the Nasdaq.

advertisement

advertisement

High Times

shares are set at a value of $11, a 10% discount from the anticipated opening price on the Nasdaq. The Reg. A+ filing has a $50 million cap.

“Given the fan base we created, it

is important we allow our loyal brand followers the opportunity to become equity owners of the company,” Levin said at the time.

The campaign gives investors an early

opportunity to participate in what will be one of the first cannabis-related stocks on the Nasdaq, and allows dedicated readers to own common stock in High Times' business. (Shares are

available for purchase at hightimes.com/invest.)

“It was important to me that this offering be open to anyone who wants to join this historic

moment, not just those with big brokerage accounts,” Levin added.

The 40-year-old company distinguishes itself as a business focused on media and events tied to legal cannabis

culture — it does not distribute cannabis or cannabis-infused products.

High Times, which has published a monthly print magazine since 1974, plans to use the capital

from the IPO to expand its publishing, events and licensing businesses, as well as invest in video and audio content and add product lines and brands.

Itmakes most of its

revenue from its events, such as its popular Cannabis Cup, one of the world’s biggest marijuana-focused trade shows. There will now be an “Investor’s Village” at the Cup, Levin

said.

The company also closed two acquisitions this year: It bought Green Rush Dailyin April, and

acquired Culture magazine from Southland Publishing, Inc.

High Times is extending its Reg. A+ deadline for investing in the IPO until October 31.