Just days away from the start of the NFL season,

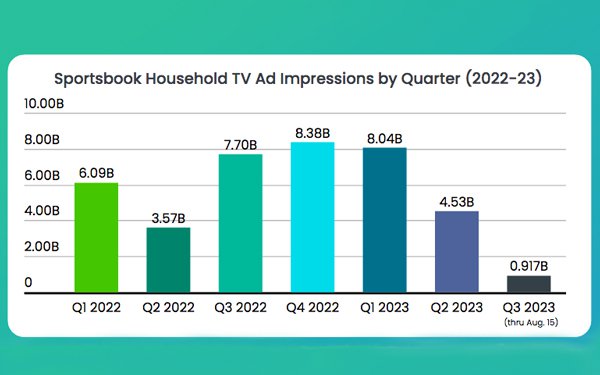

online sports wagering businesses have totaled $140.5 million in national TV advertising spending over the first six months of 2023 -- sharply up by 48% versus the same period a year ago,

according to EDO Ad EnGage.

That said, advertising spending during this period was 44% lower than the second half of the year 2022 --- $334 million -- from the May 19 to December 31,

2022 period. This is when heavy NFL season and NBA playoffs/finals programming -- and sports wagering -- are active.

Still, analysts say the most recent period shows the strength of the new

advertising category going forward even in more modest consumer sports wagering periods -- and where ongoing sports operations have increased their national TV spending.

Over the last six

months (January 1, 2023 to August 15, 2023) FanDuel grabbed a category-leading 48.8% share of total TV advertising sportsbook impressions, according to iSpot.tv estimates. A year ago over the

same period it was 39.8%.

advertisement

advertisement

Analysis from iSpot says FanDuel benefitted from non-sports TV advertising programming, such as “Friends” reruns. where the big sportsbook put 5.8% of its ad impressions.

Likewise, DraftKings bumped up its share to nearly 20.7% (from 16.6% a year ago). This sportsbook grew its ad impressions from NBA games by more than three times.

Other

competitors: BetMGM, 16.4% share; PointsBet, 3%; FoxBet, 2.9%; and others 8.1%.

Over 30% of all TV ad impressions went into the NBA (17.8%) and the NFL (13.4%) programming during the first six

months of 2023. The next highest programs: “Friends” (3.2%); PGA Tour Golf, (3.0%).

Two non-sports entertainment shows -- “Friends” and “South Park” showed

substantial increases in impressions from sportsbooks ad placements, up 394% and 528%, respectively.