Ad industry response to Meta’s

decision to discontinue fact-checking content distributed on its platforms and apps was muted following Mark Zuckerberg’s disclosure early Tuesday morning.

Ad executives contacted by

MediaPost either declined to comment on the record, or speaking anonymously, said they were still assessing the potential impact of the decision.

“As you can imagine

we’re deep in this now to get answers from Meta and assess impact / provide guidance to clients,” one big agency exec shared, adding: “I’m waiting for an update from our team

on when they’ll have that finalized. We won’t want to comment before that’s been done.”

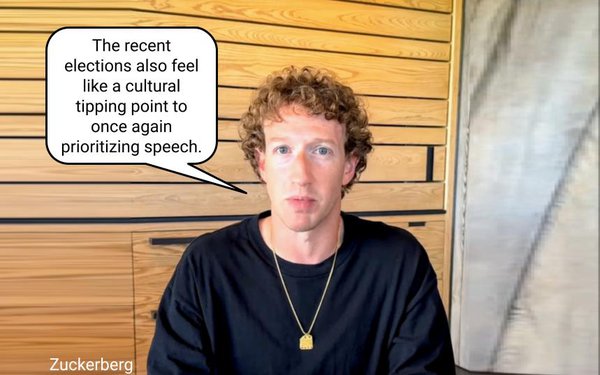

But ad industry concerns go beyond the kind of politically biased

discourse Zuckerberg alluded to in his rationalization that the decision was made because American politics has reached a “cultural tipping point” following Donald Trump’s election,

and that there are much more pragmatic reasons for advertisers to be concerned, including forms of “free expression” on social media platforms that have nothing to do with politics, per

se, but conventionally unsafe content for brands to be adjacent to, or associated with: “ie pornographic, violent, etc.,” one exec noted.

advertisement

advertisement

The move also follows a series

of efforts to shut down the ad industry’s ability to exercise its free expression in terms of when, where and on what forms of content advertisers and trade associations spend their advertising

dollars -- including X Corp.’s suit against the World Federation of Advertisers, several of its members, which resulted in the WFA’s decision to shutter the Global Alliance for Responsible

Media (GARM), the first global ad industry initiative to focus on supporting fact-based content distributed across digital media.

Meanwhile, Dentsu has quietly pulled out of an

effort with 614 Group to jumpstart a similar coalition to encourage

advertisers to invest their ad budgets in credible news outlets.

Dentsu declined to comment, but its decision to pull out of the aborted effort followed a letter sent to Dentsu Americas CEO Michael Komasinksi

by House Judiciary Committee chair Jim Jordan requesting information from Dentsu and citing the committee’s probe into the WFA and GARM.

“The Dentsu Coalition appears

to be pursuing objectives similar to GARM’s,” Jordan wrote. “Before dissolving, GARM routinely attempted to delineate which news outlets were credible enough to receive the

group’s funding. To accomplish this, GARM attempted to “provoke” its membership to work with third-party fact-checking organizations, such as the Global Disinformation Index (GDI)

and NewsGuard, to identify sources of unreliable news. Like the Dentsu Coalition, GARM justified its collusive action by claiming that the group had an obligation to support credible news and

journalism and steer investments away from other news sources.”

In response, Dentsu Americas General Counsel Susan Zoch sent a letter to Jordan describing the agency’s partnership with 614 Group as a modest “research project” and said that in

hindsight, the original press release announcing it was “hyperbolic” and was never intended to organize a GARM-like coalition.

News of Dentsu’s response to Jordan

was first reported by tech industry publication The Information.

Dentsu’s letter to Jordan outlines many of the advertising-related problems facing legitimate news organizations, including shifting ad budgets to digital media, as well as the

increasing role of “exclusion lists” blacklisting news media buys.

The letter also goes on to blame MediaPost’s original coverage, which it said

“mischaracterized the Dentsu’s and 614 Group’s effort.

“Dentsu and The 614 Group announced today the formation of a groundbreaking coalition aimed at

fostering substantial and sustainable investments in credible news,” Dentsu’s and 614 Group’s press release originally stated, adding: “This initiative comes as a response to

the growing challenges faced by journalism in the digital age, where traditional monetization strategies have struggled under the weight of brand safety and suitability measures.”

Dentsu’s announcement came less than a month after the WFA shuttered GARM, and its release uses the term “coalition” six times to describe its mission.

You can read the original release in its entirety here.

In addition, in response

to the release, a Dentsu spokesperson at the time elaborated that the goal of the coalition was to make it “truly global” and to develop a “brand safety playbook that will help

clients to understand how they can use ad verification settings and brand and agency collaborative processes to protect their campaigns while actively buying news inventory.”

While it’s understandable why Dentsu would backpedal in response to Jordan’s letter, its decision to pull out of the initiative comes at a time when the overall ad industry is

trying to come to grips with how to both support credible, fact-based news content and avoid the kind of “cultural tipping point” of politics that Meta’s Zuckerberg alluded to.

In the past half dozen years, a number of big agency holding companies, including Dentsu, WPP/GroupM, Interpublic, and others have moved increasingly away from news “exclusion

lists” and toward “news inclusion lists” based on ratings systems and judgement calls for what constitutes fact-based journalism. Some have even created explicit private marketplaces

for transacting programmatically on that basis.

Lists are not new on Madison Avenue, and go back to the earliest days of television when agencies and advertisers would hire screening

services to ensure their products and brands were not placed adjacent to “unsafe” content.

While the proliferation of digital media has exacerbated the ability to screen

and evaluate the relative safety of news and information content online, a cottage industry of services such as NewsGuard has emerged to help agencies and brand marketers identify the veracity of

content online.

The platforms themselves also invested heavily in fact-checking and content safety measures, largely to assuage the concerns of advertisers that their advertising

would not appear adjacent to unsafe content.

Nearly three years after Elon Musk acquired Twitter and began undoing much of that process on X, Meta is now following suit, and even

citing X as its role model for doing so.

Cultural tipping points aside, New York University Professor and well-known media industry pundit Scott Galloway pointed out some powerful

economics in Zuckerberg’s decision during an interview on MSNBC’s “Morning Joe” this morning, noting, “he gets to save maybe upwards of $5 billion, which is how much they

spent on their safety and security department – and a price/earnings ratio of 30 – that’s potentially a $150 billion increase in market capitalization.

“Mark

Zuckerberg owns 15% of the company.

“So you have what is effectively a get out of jail card potentially from someone who appears to be an oligarch threatening to put people in

jail and add $15 billion to $20 billion to his net worth.”