New research shows that

bundling is a big opportunity for premium streamers looking to add subscribers in a mature streaming business marketplace. But this depends on the combination of platforms.

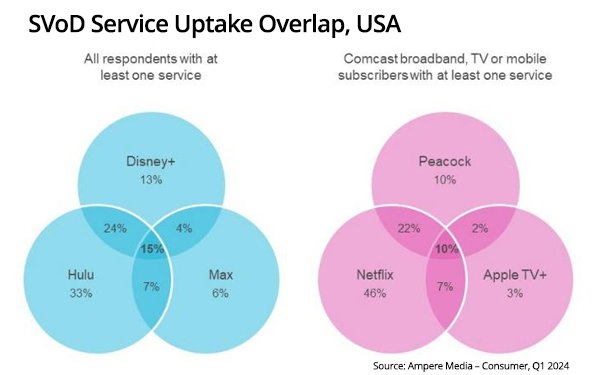

Ampere Analysis says the Walt Disney-Warner Bros. Discovery’s proposed bundle of Disney+, Hulu, and Max shows that just 15% of subscribers currently take all

three.

Another new bundle -- offered by Comcast, for its mobile, broadband, and cable TV customers -- shows just 10% of subscribers take all three of Netflix,

Peacock and Apple TV+. Comcast owns NBCUniversal and its Peacock streaming service.

Ampere Analysis note it has become harder in a maturer streaming business to

add new subscribers -- especially for those medium-sized and small streaming platforms.

advertisement

advertisement

“As the subscription video market in the US has become increasingly

saturated, new subscribers are harder to find, which makes retention all the more important,” writes Daniel Monaghan, research manager at Ampere Analysis

Services such as Peacock and Apple TV+ plus could make significant gains in combination with the industry’s premium streamer leader, Netflix.

Even

a bundle of just two of any of these major premium streamers can also mean strong results. For example, there is just 4% of subscribers who take both Disney+ and Max. There is only a 2% overlap when

it comes to Peacock and Apple TV+.

For Hulu and Max, just 7% subscribers take both -- and only 7% take both Netflix and Apple TV+.

It seem Walt Disney, starting with its original bundle back in late 2019 -- Disney+ and Hulu/ESPN+ -- had the right idea.

Ampere says that 59% are

less likely to "churn" -- or opt out of -- that bundle within 12 months than those that take Disney+ alone.

These are U.S. streaming subscribers who “regularly subscribe, cancel,

and resubscribe.”

Ampere’s first-quarter 2024 research was produced between February 5 and March 6 of anonymized subscription receipt data

from a panel of three million opted-in U.S. email users.

Overall, a huge chunk of streaming subscribers are what the authors call “re-subscribers,” at 42%.

The research also says that re-subscribers are mostly younger viewers (18-44 years old), and more likely to be in family households.

The problem of

re-subscribers is that heavy TV users are 40% more likely to experience “subscription fatigue.”

According to the research, 21% of this group wants “unified access of

content across different services.”