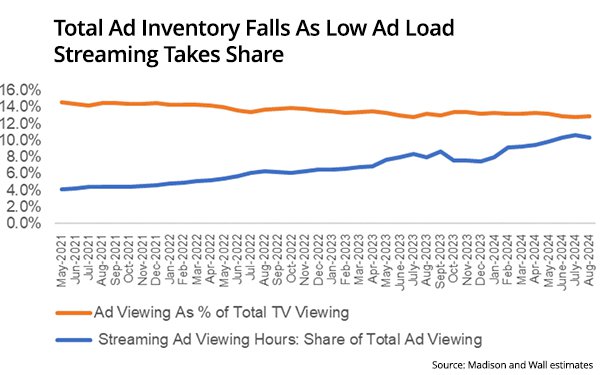

Total TV viewing time of all advertising content -- linear TV and streaming platforms -- continues to drift lower, according to the Madison and Wall Substack

publication.

In August, total advertising time viewed was down 0.8% to 4.5 billion hours -- a 13% share of all TV viewing time (content and advertising). The previous year, in August

2023, it was at a 13.2% share. Two years earlier, in August 2021, it had 13.7% share.

Total TV programming content viewing time was at 87% share -- 30.5 billion hours.

“The reason for the reduced volumes of ad inventory are due to growth in viewing of ad-free and ad-light streaming services,” writes Brian Wieser, of Madison and Wall.

More specifically, Wieser estimates while total ad-supported viewing hours fell by 0.8%, total TV viewing climbed 3.5% year-over-year, per Nielsen. This was largely due to heavy Paris

Olympics viewing consumption in August.

advertisement

advertisement

In addition, Wieser says, the drop comes amid increased streaming ad inventory this year -- attributable mostly to Amazon Prime Video, which

started up as an ad-supported option in January.

“[Streaming ad-supported] growth means that even as increasing numbers of subscribers choose ad-supported plans -- especially

for Disney+ and Warner Bros. Discovery’s Max in recent months -- [it is] not enough to offset the lower ad loads that necessarily exist in primarily on-demand streaming environments relative to

primarily passive linear TV environments.”

Looking only at premium streaming platforms, its share of ad inventory was at 10.3% in August 2024 -- up from 8.0% in August 2023,

6.3% in August 2022 and 4.4% in August 2021. This excludes YouTube -- which, according to Wieser, is still not generally budgeted as part of a TV media plan by most large marketers.

Breaking down individual streamers, Wieser estimates Disney has the largest ad share (22%) followed by Roku (20%); Paramount Global (16%, Paramount+ and Pluto); Fox’s Tubi (13%);

and NBCU’s Peacock (12%). Farther down the list are Amazon (8%) and Netflix (5%); and Warner Bros. Discovery’s Max (2%).

Wieser estimates legacy-based TV-network based

media companies roughly pull in over a 30% share of their overall video advertising revenue from their respective streamers' platforms.

Madison and Wall’s analysis is informed

by data on ad-free and ad-supported subscribers produced by Antenna which are paired with additional estimates related to ad loads.