Total global FAST

viewing hours climbed 38% in the third quarter of this year, with advertising impressions rising 41% year-over-year, according to Amagi, a media technology company.

The biggest

market for FAST (free ad-supported streaming television service) is in the U.S./Canada, which have a commanding 66% share of all global viewing FAST content and 81% of global ad impressions. Viewing

hours were up 24% year-over-year, with ad impressions 38% higher.

Asia-Pacific territories had the biggest growth -- with an 118% increase in viewing hours and 105% in ad

impressions.

Media technology company Amagi conducted research analyzing more than 2,800 FAST channels that use its Thunderstorm server side ad insertion platform.

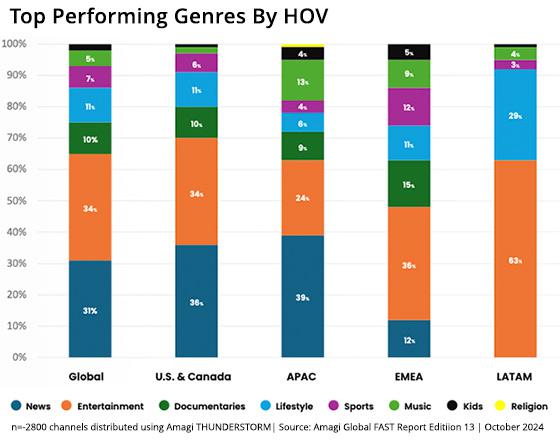

The majority of viewing content in the U.S. and Canada FAST channels comes largely from news and entertainment programming -- at 36% and 34%, respectively, according to Amagi.

advertisement

advertisement

New sports FAST channels recently launched include: NBA G League TV; DAZN (European football, boxing, MMA, tennis), Tennis Channel and Virgin Media O2 (European football).

Other significant areas as content providers in the U.S. and Canada include lifestyle programming (with an 11% share) and documentaries (10%).

New FAST channels launched

globally after September 2023 are helping overall FAST growth -- now accounting for around 30% of total viewing hours and advertising impressions.

Entertainment content for those new

platforms are growing as well -- contributing a 65% share in viewing hours and ad impressions.

Total global FAST viewing hours climbed 38% in the third quarter, with advertising

impressions rising 41% year-over-year.

Amagi notes that its FAST report is not a universal data set of all global FAST channels and FAST services.