The general economy historically has been seen as a leading

indicator for U.S. ad spending, but a new, first-of-its-kind analysis suggests it may be the other way around, at least in terms of the impact of local ad-spending trends on state-level economies. And

it doesn't bode well for foreseeable quarters.

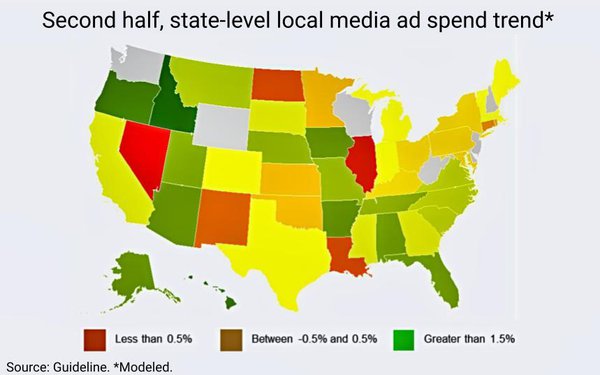

The analysis, conducted by

a new econometric modeling team at ad spending tracker Guideline, indicates that recent cuts in local ad spending have accurately predicted declining GDP in about a third of U.S. states in the second

half of this year, and based on continuing local ad-spending trends, the Guideline team predicts that will rise to about half of U.S. states in the next quarter or so.

"In the next three-ish

months, what we're seeing in our model today, is that about half the state in the U.S. will be in negative territory from a GDP perspective," explains Sean Wright, who recently joined Guideline as

Chief Insights and Analytics Officer, after years of market intelligence and NBCUniversal, and at Anheuser-Busch before that.

"Does that necessarily equate to a recession? Not necessarily,

depending on those states' contribution to the overall GDP," he said during a briefing taking me through the new Guideline model, "but our data is pointing to a material weakening in the ad market,

because economically, a lot of states are starting to struggle."

Wright's model is interesting to me for several reasons, including the fact that I've covered the correlation between the U.S.

ad economy and the general economy for nearly half a century, going back to the early days when the late McCann-Erickson forecaster Bob Coen made his annual and semi-annual forecasts.

Back

then, Coen always included a section showing a strong correlation between ad spending as a percentage of the U.S. economy, but he never determined which was the leading and which was the lagging

indicator.

And while ad spending historically lagged going into and coming out of U.S. economic recessions on a national level, Guideline's Wright says that likely is because it's easier for

big national brands to move budgets around depending on what categories they're in, and the effects tend to be more lagging on a national level.

But on a local/state-level, impacting many

small- and medium-size advertisers, economic volatility tends to have more immediacy and the new analysis proves it.

"It's more of a bellwether for a weakening economy," Wright said,

estimating that shifts in local ad spending are about a 1.5 times more predictive indicator of the economy than national ad spending has historically been.

While a few states appear to be

outliers that are less predictable -- New Jersey, Wyoming and Washington, for example -- and at least one state (Hawaii) is showing inexplicable growth, Wright said the data points to an overall

downturn in state-level economies that the ad industry should consider in near-term media planning and buying.

"As an agency or a publisher, I'd want to get out ahead of this," Wright

cautioned, suggesting that media sales organizations might want to do what they can to pre-book advance ad sales, while agencies might want to hedge on greater flexibility until the economic outlook

becomes more stable.

In terms of national ad commitments, national TV upfront advertising buys historically are firm for the fourth quarter, are about 25% cancelable for the first, and 50%

cancelable for the second and third quarters of each year.

Wright said he plans to update the analysis over time and is beginning to look at correlating other forms of economic data to make

Guideline's core ad spending data more meaningful and actionable to different stakeholders, including economists, as well as advertisers, agencies and the media.

Stay tuned.