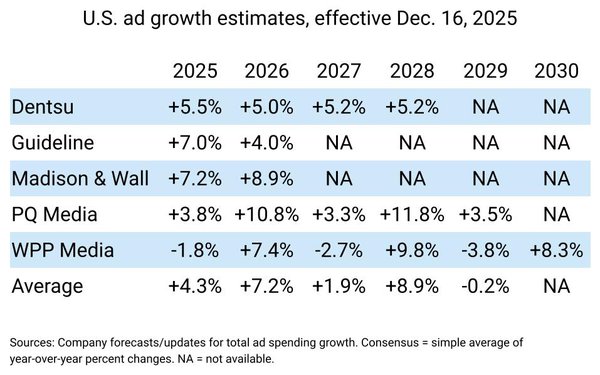

As far as works-in-progress go, this one may take

a few iterations before it's nailed down, but this is my current revised industry "consensus" forecast for U.S. ad-spending growth.

It follows the demise of two of the big agency holding

companies' -- Publicis and Interpublic/Omnicom -- long-time public ad

industry forecasts, and I'm doing my best to cobble an alternate version based on a mix of widely sourced providers of ad industry forecasts, including a mix of the two remaining holding companies --

Dentsu and WPP Media -- as well as analysts, consultants and syndicated research providers.

Last week, I added WARC to a revised global ad-spending consensus, and as soon as I did, others

stepped forward to participate periodically, including PQ Media, which I'm adding to this version for the U.S. ad-spending outlook.

advertisement

advertisement

I've also added Madison and Wall's recent update,

as well as new estimates released to MediaPost by ad tracker Guideline, which officially entered the forecasting game in October.

Guideline this week has issued

its first outlook for 2026, calling for the U.S. ad marketplace to expand 4.0%, which is on the low end of the most recent estimates from other sources.

In addition, Guideline has revised its

2025 growth figure up 1.4 points to +7.0% from the +4.6% it was projecting as recently as late October.

Full disclosure: There are many apples-to-oranges factors in what this composite of

sources measures as "ad spending."

Guideline, for example, is powered by an empirical database of actual advertising buys by the major holding companies and independent media agencies, but

Chief Insights and Analytics Officer Sean Wright utilizes modeling to calculate gross industry estimates.

Similarly, some sources include or exclude different line items for ad-supported media

in their gross calculations.

"For an apples-to-apples comparison, it should be noted that [PQ Media] include search and few other digital channels in the marketing, not advertising, sector,"

explains PQ Media Executive Vice President-Research Leo Kivijarv. PQ's marketing sector is more encompassing of total marketing expenditures, but for the purposes of this industry composite, we're

citing pure-play ad spending and utilizing each source's own definitions for what goes into that.

The goal of this composite is to be a directionally accurate consensus, while also including

each provider's estimate to understand the ranges.

Lastly, in the spirit of being as apples-to-apples as possible, the composite is sourcing each provider's estimates for total ad spending

each year, not those excluding the impact of political ad spending.