The number of marketers with

in-house agencies has grown sharply over the past five years, according to a new study from the National Association of Advertisers, based on a poll of its members.

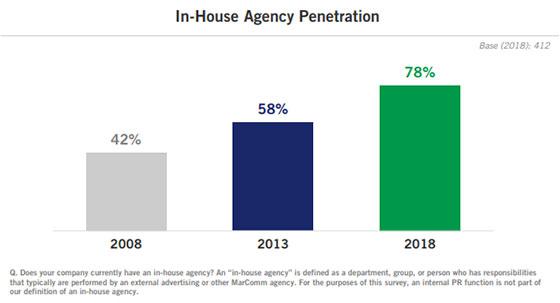

The study shows that more

than three-quarters (78%) of ANA members reported having some form of an in-house agency in 2018, compared to 58% in 2013 and 42% in 2008.

And 90% of those polled in the most recent study

indicated that the workload of their in-house agency has increased in the past year, including 65% who said the workload has increased “a lot.”

The survey revealed that in-house

agencies provide a range of services, including strategy, creative for both traditional and digital media, and media planning and buying. Services that have grown significantly over the past five

years include creative strategy, media strategy, social media (both creative and media), and programmatic media buying.

advertisement

advertisement

"This report makes clear that the work being done by in-house agencies

is no longer confined to 'low-hanging fruit' such as collateral/promotional materials and internal videos," said ANA CEO Bob Liodice. “Traditional agencies are becoming increasingly challenged

as marketers move more work in-house while encouraging their external agencies to provide differentiated services and increased value. We expect the current trends to continue, with accelerated client

movement to in-house agencies."

The report comes amid a period of strained relations and declining trust between advertisers and agencies. Last week the ANA confirmed that the Federal Bureau of Investigation and the U.S.

Attorney’s Office For The Southern District Of New York had launched a criminal probe into media-buying practices. The Bureau came to the organization for help in identifying potential victims

of fraudulent media-buying practices and the ANA’s CEO Bob Liodice issued a letter to members suggesting steps they might take if they believe that they are victims.

That investigation

follows a scathing report from K2 Intelligence commissioned by the ANA in 2016 that highlighted sketchy media-buying practices such as accepting rebates from media companies for spending client ad

dollars with them without informing clients.

Commenting on the ANA study, Pivotal Research senior analyst Brian Wieser wrote in a client note that the growth of in-house agencies may be

a factor in decelerating external agency revenue growth, but likely not the biggest factor.

“From our vantage point," Wieser noted, "we have observed that

reduced spending on creative services in general paired with enhanced contract scrutiny on media agencies are probably the biggest factors impacting the business. Of course, both those trends overlap

with aspects of in-housing.”

Respondents to the new ANA study said that cost efficiencies were the primary benefit of moving agency services in-house, followed by

better knowledge of brands, speed and nimbleness, and institutional knowledge.

Nearly 80% of respondents expressed high levels of satisfaction with the work of in-house resources, with

37% indicating they were “completely satisfied” with the work being done by these teams.

That said, the survey also showed that 90% of respondents still work with external

agencies.

The study also found that:

- Over the past three years, 70% of respondents have moved work formerly handled by their external agency(ies) to their in-house operation,

including content marketing, social media, and influencer marketing.

- 79% have in-house video production capabilities, and almost half established those capabilities within the past five

years.

- Top KPIs used to assess the effectiveness of in-house agencies are cost savings, speed to market, and business performance.

- The biggest challenges for in-house agencies are

related to managing growth. Specifically, the two top challenges are managing workflow (increased projects) and efficiently managing resources.

The study also indicated that there has

been a marked increase in the amount of specialty services offered by in-house agencies in the past five years.

Case in point: Content marketing is handled in-house by 75% of respondents

compared to 34% in the 2013 survey, while data/marketing analytics are handled in-house by 59% of respondents versus 42% in 2013.