Mobile media top the list of 2022 media

priorities, according to a November online survey of 230 U.S. “digital experts” by Integral Ad Science (IAS).

One third of respondents were advertiser and brand executives, 18%

media agency executives, 22% publishers, and 15% creative agency executives. The remainder were from ad networks and exchanges, supply-side and demand-side platforms and trading desks.

Asked

which media environments and ad formats will be top priorities in the year ahead, 76% cited mobile (including apps and web), 72% social media, 61% digital video (including over-the-top and connected

TV), 56% desktop environments, and 48% digital audio/podcast in-stream display.

The stress on mobile advertising reflects consumers’ greater mobility, despite lingering pandemic

restrictions.

advertisement

advertisement

Mobile video, in particular, is poised for growth. “As more consumers shift from remote work to hybrid lifestyles, mobile video streaming is on the rise, and 86% of media

experts see it as a key opportunity in the year ahead,” reports IAS.

More than 80% also said that contextual targeting solutions will gain favor in mobile app and web environments;

that expanding 5G adoption will create new advertising opportunities; and that third-party verification will be key in ensuring the quality of mobile inventory.

However, 77% said that ad

fraud will be a greater concern across mobile environments in the coming year, and within mobile, web video and in-app video are seen as most vulnerable to both ad fraud and brand risk.

(See charts summarizing media environments’ perceived ad-fraud and brand-risk vulnerabilities, as well as charts showing ad industry challenges and challenges by media channels,

below.)

Asked which social platforms they will buy advertising in or monetize content in, Facebook, YouTube and Instagram continued to dominate heavily, but Twitter gained ground, and

TikTok was cited by 40% —up from 21% in the same survey last year. (Chart above.)

But 79% said ad fraud is a top concern with social, 49% said social media will be vulnerable to

brand-risk in 2022, and 60% cited eroding consumer trust as a key factor in adjusting social spending for the year.

Facebook (65%), Instagram and Twitter (53% each) are the platforms

most-cited as likely having their advertising investment impacted due to eroding consumer trust.

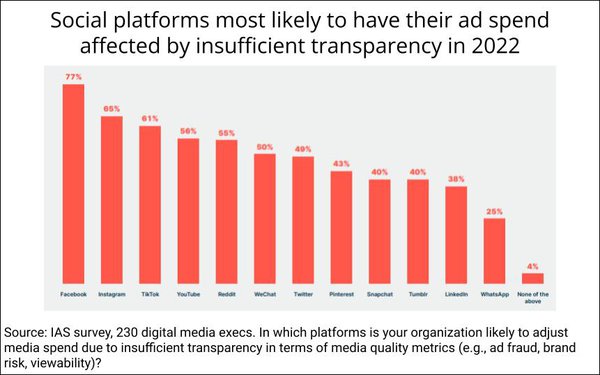

Overall, 56% said they’re likely to adjust social ad spend due to insufficient

quality media metrics (ad fraud, brand risk, viewability), although that was down slightly from 2021 (59%). On this front, respondents express most dissatisfaction with Facebook, Instagram and

TikTok.

Looking at television,

82% agreed that consumers’ shift away from linear TV towards digital video alternatives will accelerate, 79% that ad-spending shift in the same direction will accelerate, and 77% said that ad

buyers will expand into more streaming services as consumers diversify their platforms.

Nearly half (46%) said that CTV and digital video hold the most potential for innovation in 2022.

And despite statistics showing a rise in fraudulent ad activity in unprotected programmatic CTV (certainly in Q4), just 10% of respondents said that CTV will be the environment most vulnerable to ad fraud

in 2022, down from 26% last year. “This decrease signals growing confidence in the industry’s ability to counter invalid traffic threats on one of the hottest environments of the

moment,” according to IAS.

Looking at digital audio,78%agree that ad-supported audio streaming will grow in popularity among consumers, and 75% expect ad investment

in this medium to expand in kind.

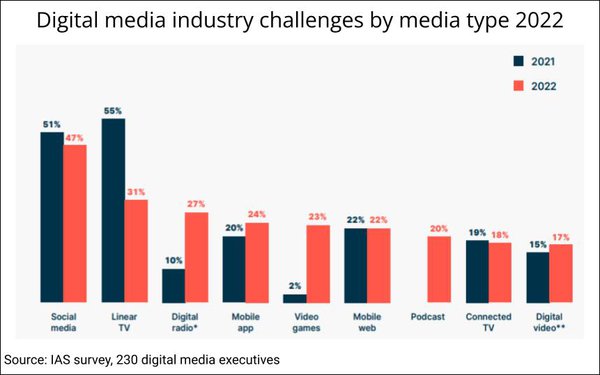

However, 27% think that digital radio will face serious challenges across the media industry in the next 12 months (more than double last year), and 81%

say that third-party verification will be important to ensure the quality of this inventory.

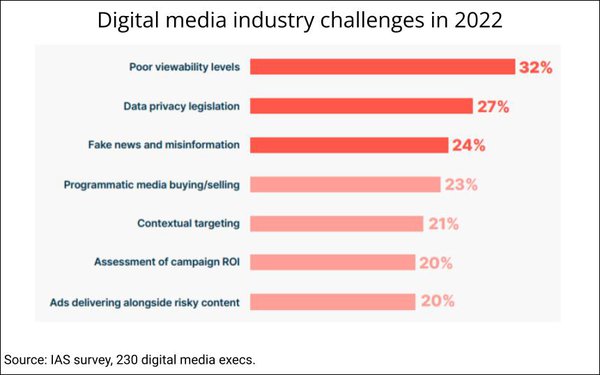

Looking at overall digital media industry challenges, data privacy regulation and fake news are now

ranked in the top three, along with poor viewability levels.

Social media and linear TV continue to be the media most-cited as presenting

advertising challenges, but this is less pronounced than in last year's survey.

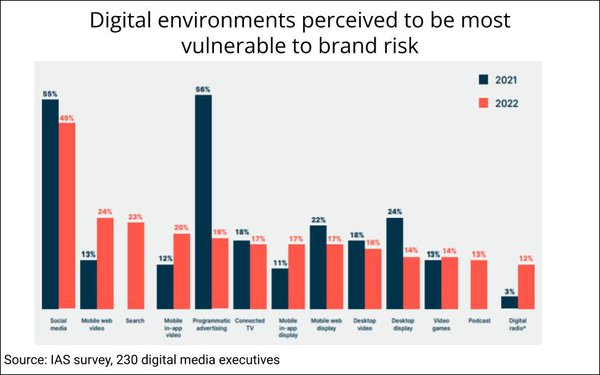

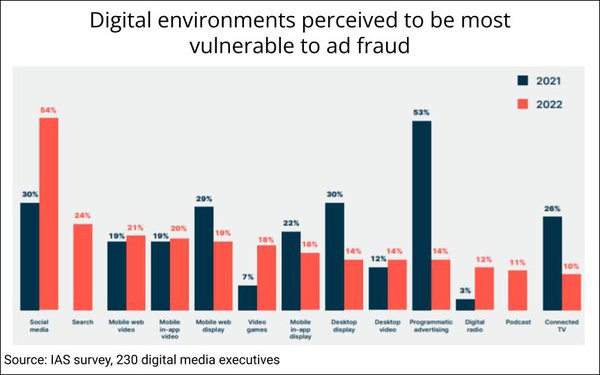

Looking at digital environments perceived to be most vulnerable to ad fraud,

far fewer of this year's respondents view programmatic advertising, along with CTV, as most problematic, but perceptions of social media's safety appear to have deteriorated.

When it comes to perceived brand risk, social

media is still the most-cited medium. In this area, too, programmatic's perception is significantly better among this year's respondents than last year's.