Continuing their solid gains,

U.S. advertising revenues in the second quarter of 2025 are now estimated to have grown 10.3% -- excluding political advertising -- according to Madison & Wall.

“Six of the

past seven quarters have featured annual underlying advertising growth of around 10%, which is a remarkable feat for a low-ish inflation economy, considering the economy only grew in a range of 4% to

6% in nominal terms during that period,” says Brian Wieser of Madison & Wall.

All digital advertising was up 15.8% -- while maintaining around a 70% share of all U.S.

advertising spend.

Wieser sees newer digital-first marketers probably operating “with more advertising-intensive business models.” He points to IRS data that shows

e-commerce-based retailers can spend four times as much on advertising for every dollar of sales they generate.

advertisement

advertisement

Total TV (including connected TV) slipped 1.7% in the period --

although CTV itself did grow. Outdoor advertising rose 3.6%, while audio and publishing slipped 0.4% and 0.8%, respectively. Direct mail was up 0.8%.

Going forward, however, he says,

ongoing concerns over tariffs will raise risks for the U.S. economy and the advertising marketplace -- digital platforms in particular.

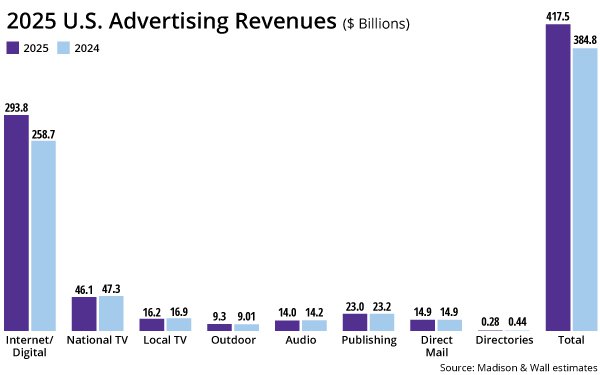

Currently, he projects that for the full 2025

year, U.S. advertising (ex-political) will rise 8% to $417.5 billion, with digital media growing 14% to $293.8 billion.

Total TV -- national, local and CTV -- will drop 3% to $62.3

billion.