TV upfront brand budgets are now allocating on average

around one-third of the media schedules to streaming platforms, according to iSpot.

Linear TV advertising impressions are still at a high level.

Overall, linear TV advertising

impressions continue to dominate the TV advertising ecosystem, representing an 85% share in March 2025 -- down from 92% in January 2023.

Over that period, all OTT/streaming ad impressions

climbed to 14% share -- up from 6%.

In the first quarter of 2025, linear TV ad impressions were at 1.54 trillion -- down 4.3% from the year before.

National TV linear ad spending then

was estimated to be up 4% compared to the year before.

On average, 32% of overall upfront TV advertising budgets go to streaming platforms, according to the TV advertising-focused measuring

company -- with the top third of all TV upfront advertisers spending nearly half, or 48%.

advertisement

advertisement

Upfront TV deals -- where brands buy for the full TV season ahead of time -- typically represent

around 70% of all year-round national TV advertising.

Total year-round TV media deals include agreements made in the near-term scatter market.

The research here comes from a survey of

260 marketing executives representing 208 brands and media agencies.

Top individual brand categories for streaming platform media spend include travel -- where brands place 33% of their TV

budgets -- home/real estate (26%), pharmaceutical/medical (24%), and restaurants (23%).

On the flip side, education (18%), retail (16%), insurance (16%), vehicles (13%), and entertainment (7%)

are at relatively low share allocation to CTV.

One recommendation from the study is that all brands -- on average -- should shift 6.3% of the budgets to CTV to get better key performance

indicators (KPIs) and decrease linear TV impressions.

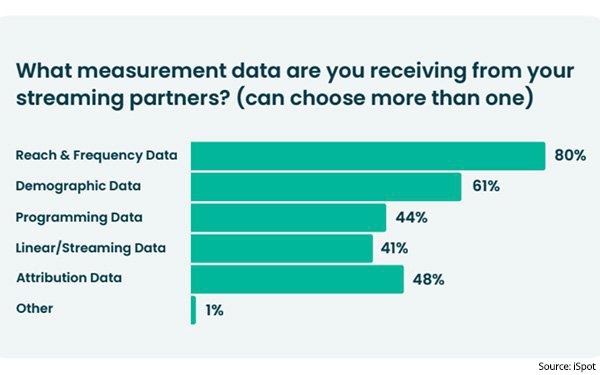

More than three-quarters of media executives who buy streaming (80%) say they get reach and frequency data from platforms, while 61% say

they get demographic data and 44%% get contextual/programming data.

With regard to "contextual" data, the report says this low level makes “it hard to optimize spend," adding: "This

underscores the importance of unified, cross-platform measurement.”

Fifty-three percent of media-buying and brand executives say "business outcome" is the most "critical" data when

making streaming TV buys, while 27% say it is "value" data, 11% say it is "verified ad delivery" and just 9% cite "program" data.