Media expenditure for advertisers is

expected to reach $664.2 billion in 2026, with continued shifts in market share from offline media to digital, data-driven channels following a stable 2025.

The 2025 year-in-review

numbers and predictions for 2026 released today are detailed in Winterberry Group’s “Outlook for Advertising, Marketing and Data 2026: Continuous Evolution."

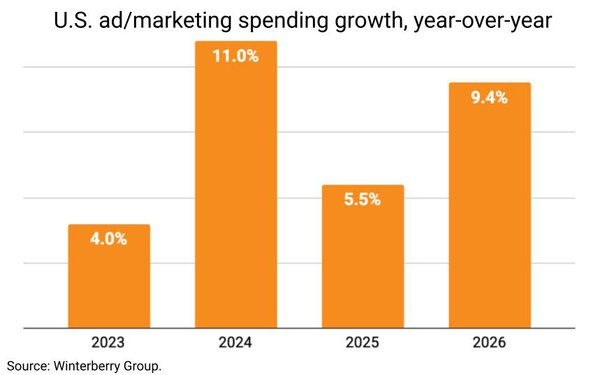

A year ago, The

Winterberry Group had predicted spend in U.S. advertising, marketing and related data to top $585 billion, but the industry in 2025 exceeded that with a stronger than expected second half, reaching

$607.4 billion.

“With moderate inflation and increasing use of machine learning and AI, the macroeconomics underlying the media market were surprisingly stable, leading to net growth

after inflation,” Winterberry Group Executive Chairman Bruce Biegel stated.

advertisement

advertisement

Forecasts for 2026 expect an even better year. Ad buys for sporting events like World Cup, and

Winter Olympics, as well as U.S. midterm elections is forecast to increase this year’s ad forecast. Political spend will drive more than $10 billion in advertising, lifting overall growth

from 7.6% to an estimated 9.4%.

Investments in AI data-released spending is forecast to reach $30 billion, according to the firm.

Video formats will lead driving engagement with

linear, social or connected TV (CTV).

Trend data also shows significant investments in data infrastructure to support the rise of agentic AI, changing how marketing technology is used across

the entire ecosystem.

While the overall increase in 2025 media spend rose 5.5%, nearly three times the growth of U.S. Gross Domestic Product, the shift in the mix of spend across channels

stood out. Consider that in 2022, the 56.4% of all marketing spend was attributable to online channels, whereas in 2025 that share had grown to 65.1%.

Direct mail, linear television, radio,

print, and magazines each posted declines in 2025, about 3% compared with the prior.

Search, social, display, video, CTV, and digital out-of-home grew at least 5%, with the overall increase

for online marketing up 11.1%. Spend on data services and data infrastructure to support all marketing rose by 3.5% to $30 billion.

Offline media is forecast to decline in spending this year.

While elections are a catalyst to lead direct mail and linear TV to both post gains this year, shopper marketing and sponsorships will soar, the latter aided particularly by global sporting

events.

Digital will continue to thrive -- growing by 12% in 2026, led by CTV, social, video, and creator marketing.

Marketing-related data, data services and infrastructure spending

are expected to grow by 8.7% to $33 billion in 2026.

The report also points to at least one other major event that drove 2025 and is expected to continue through 2026.

Mergers and

acquisitions are near record levels. Global mergers and acquisitions in the marketing field reached $4.9 trillion in 2025, the second-highest year recorded. There is consolidation across the board --

among agencies, media companies and marketing technology.