Across the spectrum of mobile

advertising, smartphones handily beat out tablets and in-app advertising outpaced the mobile Web in impression volume in the first half of 2014, according to mobile ad firm Medialets' Mobile

& Tablet Advertising Benchmarks report.

The vast majority (88.3%) of mobile ads served from January through June, 2014 were served to handsets, with the remaining 11.7% begin served to

tablets. In-app inventory accounted for 58.2% of all ads, while the mobile Web made up 41.8% of impressions.

For its Mobile & Tablet Advertising Benchmarks report, the company analyzed

over 300 billion mobile ad impressions from January 1 through June 30, 2014. A company representative said it’s “all mostly programmatic traffic … analyzed from publishers,

networks, DSPs and exchanges.”

advertisement

advertisement

While smartphones have a big head start, the data suggests that, looking ahead, tablets will command more attention. The click-through rate on tablets

was 0.59%. While that is a meager number on its own, it’s 44% higher than the click-through rate on handsets (0.41%).

Going deeper, in-app advertising is set to become even more of a

focus for advertisers. The click-through rate for in-app ads was 0.56%, compared to just 0.23% for the mobile Web.

Retail accounted for 37.9% of all mobile impressions over the first half of

the year -- data that is in line with a recent Smaato report that says retail is

now the number one vertical when it comes to spend in mobile RTB.

Combined, networks and exchanges accounted for less than one-fourth (22.4%) of all impressions. The full breakdown: Network

(48.3%), publishers (29.3%), DSPs (18%) and exchanges (4.4%).

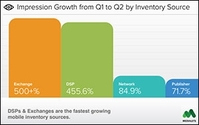

However, ad exchanges and DSPs are the two fastest-growing mobile inventory sources -- and it’s not even close. Networks saw

their inventory growth increase by 84.9% from Q1 to Q2, 2014, while publishers saw 71.7% growth. On the other hand, exchanges saw over 500% growth quarter-over-quarter, and DSPs saw 455.6% growth.

The click-through rates from exchanges (0.11%) and DSPs (0.30%), however, are abysmal. Networks (0.60%) and publishers (0.47%) still boast significantly better click rates.