The impact of the COVID-19 pandemic on marketing

strategies drove even greater shares of advertising to the tech giants.

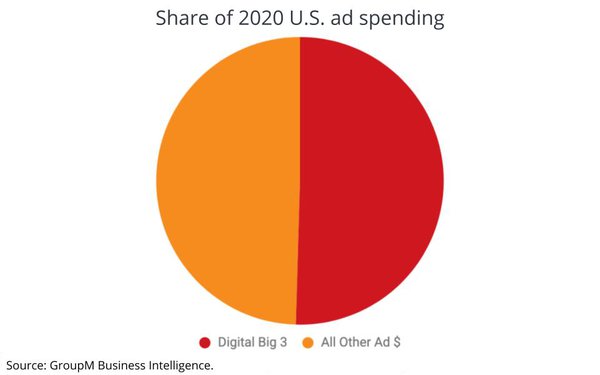

Result: Collectively, Google, Facebook and Amazon for the first time attracted the majority of all U.S. ad

spending last year, according to a provisional GroupM analysis published by The Wall Street Journal.

Based

on WSJ’s chart using GroupM estimates (not shown here), Google is estimated at roughly $65 billion to $70 billion in U.S. ad revenue for 2020, Facebook at roughly $30 billion to

$35 billion, and Amazon at roughly $15 billion to $20 billion, within a combined total of roughly $115 billion to $120 billion.

advertisement

advertisement

The "Triopoly" grew their share of U.S. digital ad dollars to

nearly 90%, from about 80% in 2019, GroupM estimates.

The underlying trends, driven by heightened online time and ecommerce — as well as new-business startups

— during the coronavirus shutdowns, include the platform’s ability to collect even greater amounts of user data and share it with advertisers, and improved ability to demonstrate

return on investment, notes the article.

“These companies that are data-science-driven get stronger and faster with a tailwind of usage — and Covid was a hurricane,”

Tim Armstrong, founder of a D2C facilitator firm, The DTX Company, and the Flowcode QR code and a former Google executive and AOL CEO, observed to WSJ.

Examples cited of major

brands shifting ad dollars to the big platforms include Mondelez moving funds tagged for 2020 March Madness games and the Summer Olympics to Google (which provided snacking insights from search data);

athleisure company Vuori tripling its ad spend on Facebook platforms; and office furniture company Steelcase using Amazon to advertise its new D2C business.