Talk about a perception

gap.

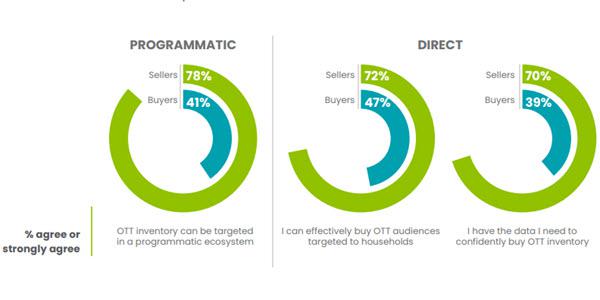

While 70% of sellers believe they provide enough data for streaming ad campaigns, just 39% of buyers agree, according to a survey of 608 buyers and sellers conducted by Dynata for

Conviva’s 2021 State of Streaming study.

In addition, while nearly three quarters of sellers agree that streaming inventory can be targeted in a programmatic ecosystem and

effective audience targeting to households exists for direct buys, fewer than half of buyers agree.

Most buyers are also dissatisfied with transparency about inventory and

brand safety.

While 59% agree they have the data they need to confidently buy CTV inventory, just 10% are satisfied with episode-level brand visibility for programmatic streaming buys. And

just 8% agree that streaming content’s context is generally safe for their brands.

advertisement

advertisement

However, buyers within that 8% were 174% more likely to say they recommend OTT.

This “massive divide” between buyers’ and sellers’ views of streaming’s current status, says cloud-based data analytics platform Conviva, goes a long way toward

explaining why PwC projects that U.S. advertisers will spend just 8% of their budgets on streaming even in 2024 — even as 47% of viewing time is already spent on streaming.

Dynata

also fielded a survey of 1,944 adult U.S. consumers during the mid-February to mid-April study period.

The study examined 22 different attributes, but only seven were identified as key

drivers of viewer satisfaction with streaming advertising.

Positive sentiments about ad experience, relevance, and privacy protections on streaming were strongly associated with overall

satisfaction with ads on streaming services.

Still, the overall picture that emerged isn’t great.

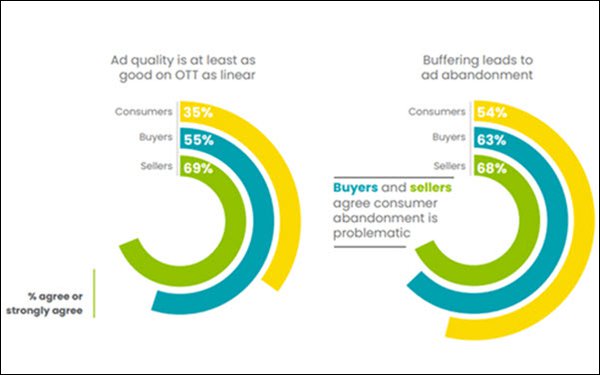

Only a third (35%) of consumers — along with just 55% of

buyers, and 69% of sellers — agreed that the quality of ads on OTT is as good as those on linear TV (chart at top of page).

Just 36% of consumers said they’re satisfied with

advertising on streaming overall, 54% said they abandon streaming when ads fail or take too long to load, and 59% said that too many streaming ads are repeated during the same break or

episode.

Further, 19% said they abandon streaming if an ad is delayed for five seconds.

More bad, but hardly shocking, news: While 56% said they’re happy

to watch ads in return for free streaming services, 75% said they usually skip an ad when they have the option.

Viewers are most satisfied when entertaining, quality content is free

— and when the ads presented are also perceived as having acceptable quality. “An imbalance in content quality and ad quality can be jarring, and not only impacts streaming ad

satisfaction, but can also impact engagement,” notes the report.

Consumers who agreed they were happy to watch some ads in return for free streaming services were 255% more likely

to be satisfied with advertising on streaming services than those who disagreed. Similarly, if viewers agreed they liked the streaming ads they saw or liked to watch ads on streaming, they were much

more likely to be satisfied with streaming advertising overall.

Viewers were 25% less likely to be satisfied with advertising on streaming services overall if they agreed that streaming

has too many ads in each commercial break or pod, and 20% less likely if they agreed that they don’t like product placements in OTT shows.

And while they value relevance, they say they

value privacy even more. Viewers who felt that the ads are generally relevant to them were more likely to be satisfied with streaming advertising overall. But when ads seem too targeted, they began to

question what data is being used to target them or where the data comes from.

Consumers who agreed that streaming services protect their privacy were 164% more likely to be satisfied

with streaming advertising overall.

But only 31% of consumers are confident that their privacy is protected, and 29% have felt uncomfortably targeted by streaming ads.

Perhaps that’s not surprising, given that only 69% of buyers and 75% of sellers said they consider privacy laws in building ad strategies and selling inventory. Yes, those are majorities, but

shouldn’t it be closer to 100% of both segments agreeing with this?

In short, when it comes to advertising, streaming viewers want brands they recognize, high-quality creative, a good

technical experience (QoE), and "broadly" relevant ads.

The report identifies four types of streaming viewers among those surveyed.

“Ad Lovers” (17%) are consistent

viewers who are happy to watch ad-supported streaming; “Heavy Viewers” (18%) are frequent streamers who aren’t bothered by ads; “Ad Apathetics” (32%) are consistent

viewers despite their dislike of the ads; and “Untapped Potentials” (34%) are lighter viewers who express strong dissatisfaction with the streaming ad experience.

Given that

the last group is both the largest and scores the lowest on all of the key drivers of OTT viewership, “there is a potentially very large opportunity to increase reach and total minutes viewed in

the marketplace by improving the ad experiences of concern to the Untapped Potentials,” stresses Conviva.