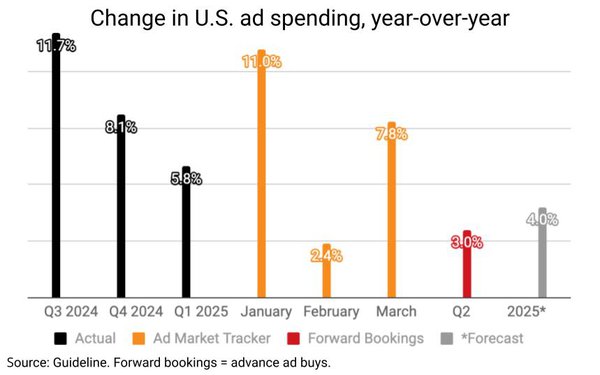

Less than five months into the year, ad-spending tracker

Guideline is already calling the rest of 2025, projecting it will rise 4% over 2024.

While Guideline is best known for its ad spending (Standard Media Index) and ad pricing (SQAD) data, the

company's analysts are making the forecast based on a quarter of actual spending data, the second quarter's "forward booking" (advance ad buys) data, previous year trends, as well as assumptions on

macroeconomic factors to project 4.0% annual growth in U.S. ad spending this year.

Guideline's forecast is in line with the current consensus of the Big 3 agency (Dentsu, WPP's GroupM and IPG Mediabrands'

Magna) ad forecasting teams' 4.1% growth estimate for U.S. ad spending this year.

advertisement

advertisement

Describing it as a "material slowdown" from 2024's U.S. ad-spending growth, Guideline's analysts attributed

the downgrade to key macro factors, including:

- Slowing consumer sentiment.

- Persistently high interest rates and elevated inflation.

- Trade

policy disruptions and tariff-related cost pressure.

- The absence of one-off events like the Olympics and political campaigns, which buoyed 2024 spend.

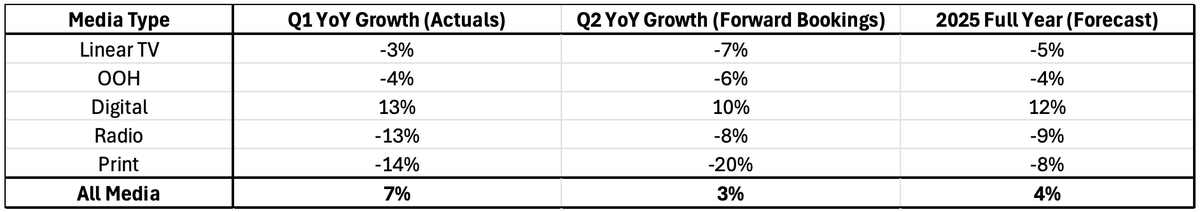

The analysis

notes that not all media will suffer equally, and that digital -- already nearing 70% of total ad spending -- is poised to increase its market share.

In fact, digital was the only media type to

experience gains in actual first-quarter growth, and currently is showing double-digit gains in forward bookings for the second quarter.

All of 2025's 4% growth forecast was attributed to a

12% forecasted gain in digital ad-spending growth this year, with all other media experiencing declines (see below).