Average daily time spent on

premium streaming platforms continues to slow and mature -- with estimates of flat to slight growth in the coming years, according to estimates from eMarketer.

One of the

exceptions this year is Peacock, which is projected to see a 15% rise to average 15 minutes per day among users 18 years and older who watch Peacock at least once per month.

This expected increase is largely because of the Paris Summer Olympics -- a heavily viewed, 17-day event that comes around every four years. After that, Peacock is projected to drift

lower in 2025 and 2026, averaging 14 minutes.

The overall leader among video streaming continues to be YouTube -- averaging 51 minutes per day among users 18 and older

-- up 2.6% from 2023.

advertisement

advertisement

Although it is projected to see slower growth in the next two years, to reach 52 minutes in 2026, eMarketer says YouTube has staying power -- yielding a top

9.1% share by the end of 2026 for all CTV/streaming video consumption.

Warner Bros. Discovery’s Max is forecast to stay in the same range as Peacock -- at 16 minutes for

2024 and for each of the next two years.

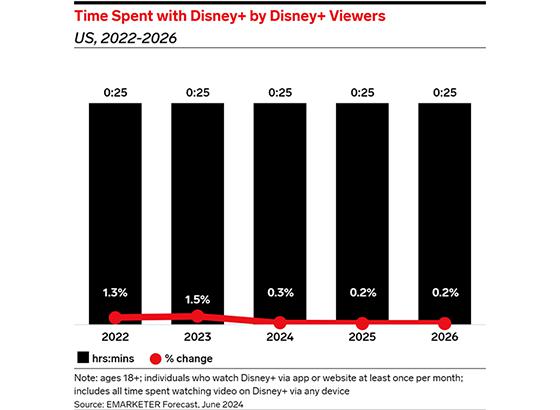

Disney+ is expected to be virtually flat for this year and for the next two years, at 25 minutes per day -- like its companion

streamer, Hulu -- estimated at 38 minutes this year with a slight increase to 39 minutes each for the next two years.

However, Amazon Prime Video -- partly thanks to its

less expensive and wide-acceptance ad-support option, which started up this year -- is projected to rise 2.1% in 2024 to 22 minutes, growing 1.6% in 2025 and 2.3% in 2026.

eMarketer also expects future NBA programming will drive viewers to the site -- where they would then be likely to seek other related Prime Video content.

This research did not include data projections from these platforms' major streaming competitor Netflix.