It’s not surprising that Google’s $3.1

billion acquisition of DoubleClick in 2007 changed the ad game, but now it seems a document known as a “pitch deck” that recently surfaced shows why a growing number of

antitrust experts believe that sort of deal should never have been allowed to happen.

Ari Paparo, CEO of Marketecture Media, obtained the document DoubleClick used to sell itself to

Google, he wrote in an online post.

Paparo has been working to gather information to publish "The Monopoly Report" newsletter, keeping in step with Google's trial.

The DoubleClick document puts a spotlight on the 2007 acquisition that played a pivotal role in the

growth of Google’s advertising business.

advertisement

advertisement

What makes this so interesting is that at one point, Paparo was the director of product management at Google DoubleClick, and the head of product

management at AppNexus.

Google’s antitrust federal court trial will take place next week in Virginia. It could change online advertising -- or at the very least, break up a company that

has spent billions of dollars and years building.

The document -- YMAG -- came to Paparo through an anonymous reader of Paparo’s newsletters. The 49-page slide presentation, Paparo

wrote, was used to sell DoubleClick to Google.

“The first five or so slides of the deck are in the DOJ’s case as plaintiff’s exhibit 104, but for some reason they do not include any of the actually interesting details,” Paparo wrote.

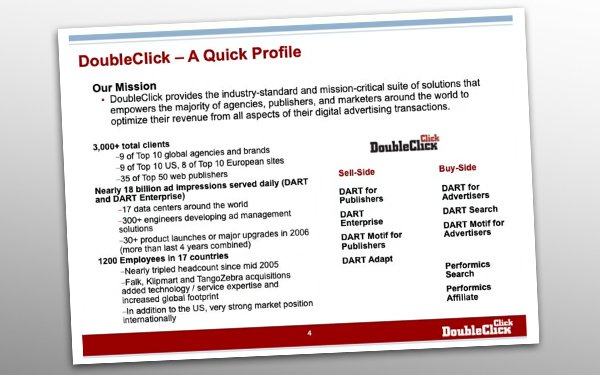

The pitch deck included information

such as DoubleClick’s mission statement, number of clients and amount of ad impressions served daily.

“At the time of this deck’s creation the ad exchange was nascent, and

still called 'DoubleClick Marketplace'," he wrote. “Elsewhere in the deck the projected 2007 revenue for the exchange is listed as just $800,000.”

The deck touted competitive

advantage as DoubleClick owning a primary ad management platform that enables dynamic allocation across direct and indirect channels and advanced targeting.

It also details buy- and sell-side

revenue opportunities, ways to maximize inventory yields, and more.

Even early on, Paparo explains, DoubleClick touted “Dynamic Allocation” as the main feature of the exchange. The

document also lists “boomerang,” a retargeting solution, as a buy-side advantage.

The ability for buyers to use their first-party data has become the basis much of the

multi-billion-dollar programmatic ecosystem and the key innovation of multi-billion-dollar companies like Criteo.

Paparo is convinced that DoubleClick didn’t really know what it had.