The Interactive Advertising Bureau (IAB) released an

update to its 2025 media spend outlook today — estimating buyers will spend less on advertising in the U.S. and focus more broadly on near-term performance. It also highlights many of the

challenges around how media buyers are trying to adjust to changes in consumer behavior.

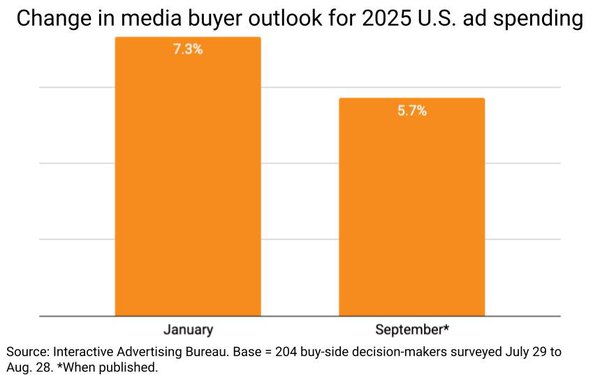

The study finds media buyers surveyed plan to spend 1.6 percentage points less than what they expected

at the start of 2025 -- dropping from 7.3% anticipated growth in January to 5.7% currently.

The shifts in the second half of 2025 show allocated budget changes, and a heightened focus on

near-term performance. Some 91% of buyers in the study expressed concern over the economic effects of tariffs, particularly in the areas of automotive, retail, and consumer

electronics.

These categories — which rely heavily on imported products and parts — are pressured to balance rising costs with demands to perform. Between 62% and

69% of buyers expect these industries to be hit hardest, and many have adjusted their spending strategies.

advertisement

advertisement

Media buyers surveyed in February cited “extreme” concerns, but

today are “somewhat” concerned, mainly because they have greater clarity on the most affected industries. Many are adjusting plans by shifting toward bottom-funnel outcomes. As a result of

tariffs, only 23% are operating “business as usual.”

The updated forecast in the 2025 Outlook Study September Update: A Snapshot into Ad Spend, Opportunities, and Strategies for

Growth is based on insights from more than 200 U.S. ad buyers across agencies and brands. The study notes that the change reflects how geopolitical forces are reshaping media buying.

Data

shows an increased focus on achieving performance, and 64% of survey participants cite acquiring new customers as their top goal. They also cite an increased urgency to drive repeat

purchases — up 8 percentage points vs. 2024, and 5 percentage points since January’s projection.

Key digital channels — social media, retail media and connected TV (CTV)

— are where buyers have turned to reach their goals. These channels are still expected to post double-digit growth.

The IAB data shows the forecasts for social media rising 14.3%, with

retail media up 13.2% and connected TV (CTV) at 11.4%.

Linear TV is now expected to decline by 14.4% — a steeper drop than the 12.7% decline the IAB had projected in January,

according to the update.

Other traditional media are forecast to decline by 3.4% — more than twice the 1.5% decline projected earlier this year.

In addition to tariff

concerns, proving incrementality and cross-channel measurement are challenges, as buyers under economic pressure need to assure that every advertising dollar is working in today’s fragmented

measurement landscape.

Some 41% of media buyers surveyed cited macroeconomic headwinds and uncertainty as challenges, while 40% were challenged

by adapting and evolving consumer behavior driven by AI and social-first search; 36% by demonstrating incrementality of media investments; 36% by executing cross-channel measurement;

32% by understanding generative AI; 30% by media inflation; 27% by managing reach and frequency; 21% by having budgets to increase emerging channel buys; 21% by mitigating ad fraud; and 20%

by maintaining budgets to increase CTV and OTT spend.