Privacy Brings Opportunity In App Installs

- by Laurie Sullivan @lauriesullivan, February 5, 2025

The mobile app ecosystem has begun another transformation. Advancements in technology -- especially AI, as well as changes in user behavior, and privacy regulations -- continue to create equal parts opportunity and complexity.

As AI takes hold to define marketing and campaign performance measurement, mobile analytics company Adjust, an AppLovin company, has released its annual Mobile App Trends Report showing global app installs rose 11% year-over-year (YoY) in 2024, while app sessions grew 4%.

The 2025 report also explores tips from AppLovin analysts, as well as key trends impacting the mobile app industry and the future of measurement. Examples demonstrate ways in which AI is defining marketing operations and campaign performance measurement

A mix of Adjust’s top 5,000 apps and the total dataset of all apps tracked by Adjust became the basis for the report.

advertisement

advertisement

The data came from two sources, with one including a list of 45 countries and one with approximately 250 based on the ISO 3166-1 standard. The report was fielded between January 2023 and January 2025.

Data-privacy regulations remain a significant barrier, but resistance to change by consumers and marketers continue to slow. This change is seen in the adoption rates of privacy-first technologies, with many continuing to increase. AI and machine learning-powered advanced analytics and real-time contextual insights are increasing the pace of decision-making for all.

App Tracking Transparency (ATT) opt-in rates, for example, rose on average 32% to 35% globally by Q1 2025. Analysts believe this is a result in consumers having more trust in brands and beginning to see value in personalized ads.

The data also shows that this year while generative AI continues to capture the spotlight, forward-thinking marketers are shifting focus to AI applications that go beyond content creation.

Predictive analytics, incrementality testing, real-time campaign optimization, and advanced cohort analysis are just a few areas where AI will drive real impact, bridge data gaps, and enable smarter, more strategic decisions.

Gaming apps have maintained the highest opt-in rate at 39%, while ecommerce and shopping apps rose from 28% to 35%. While North America ecommerce faced the steepest decline in ecommerce app installs and sessions, this region fell by 39% and 29%, respectively.

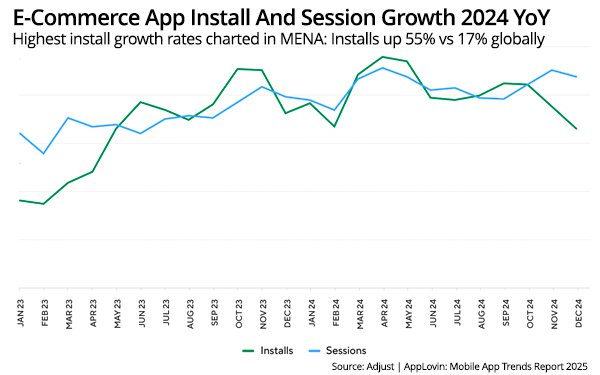

Overall, these types of app installs grew 17% YoY in 2024, and sessions rose 13%.

The Middle East and North Africa stood out globally, with installation rates rising 55% and sessions by 21% YoY. Latin America followed with 27% and 21% growth in installs and sessions, respectively, while Asia-Pacific's install rates came in strong, more than 26%, but sessions came in flat.

Gaming app installs grew by 4% YoY in 2024, though sessions declined 0.6%, with hyper casual gaming app installs making up 27% of total installs, and puzzle and hybrid casual games each contributing 11%.

Banking and crypto app installs rose 33% and sessions increased 19% YoY. Crypto apps saw a significant 45% increase in sessions. This contributed to a 27% increase in total finance app installs in 2024, with sessions increasing 24%.