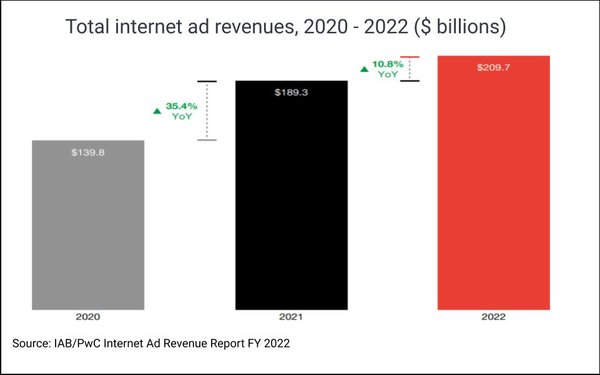

IAB: 2022 Internet Ad Growth Slowed To 10.8%, Video Logs Largest Dollar Gain

- by Karlene Lukovitz @KLmarketdaily, April 12, 2023

After a record-breaking 35% gain in 2021, internet advertising revenue’s growth slowed to 10.8% in 2022, to reach $209.7 billion, according to the latest annual report on internet revenue from the Internet Advertising Bureau (IAB), conducted by PwC.

The first two quarters saw 21.1% and 11.8% growth, respectively, but growth slowed to 8.4% and 4.4% in Q3 and Q4.

Economic uncertainty, geo-political unrest, the shifting regulatory environment and privacy-driven and other addressability changes all contributed to the slowdown, and growth is likely to be harder to achieve and less robust going forward, noted IAB CEO David Cohen.

Advertisers continued to diversify their spending within digital.

Digital audio had the largest percentage gain — up 20.9% to $5.9 billion — but its share of total digital ad revenue barely edged up, from 2.6% in 2021 to 2.8% last year.

Digital video followed closely, with a 19.3% gain, and also logged the largest dollar increase of any format: up $7.6 billion, to $47.1 billion. Video’s share rose by a strong 1.6 percentage points, from 20.9% to 22.5%

Programmatic ad revenues increased by $10.4 billion,or 10.5%, to total $109.4 billion.

Social media growth slowed, in part because of Apple’s implementation of its App Tracking Transparency opt-in policy. Social revenue rose $1.8 billion YoY in the first half of 2022, but just $0.3 billion in the second half.

Mobile grew 14.1% YoY, to reach a record high of $154.1 billion and a 73.5% share of total digital ad

revenue. Mobile’s growth will continue to be driven by increased consumption of podcasts and video, the rollout of 5G and its accompanying VR and AR advertising capabilities.

Search

still commands by far the largest share of ad revenue — and it saw 7.8% growth last year, to a record $84.4 billion — but its share is in decline. Last year, it was 40.2%, down from 41.4%

in 2021 and 42.2% in 2000.

Display, the second-largest format, saw a 12% ad revenue gain, to $63.5 billion. But while its share of total digital rose slightly YoY, from 30% to 30.3%, that was down from 31.5% in 2020.

“Democratization” of ad revenue, with mid- and smaller-tier media companies commanding growing shares, continued. The top 10 companies’ share of ad revenue decreased last year for the first time since 2016.

Looking ahead, the report cites three key factors that will continue to influence digital advertising: privacy regulations and signal loss forcing changes in data-driven targeting methods; the shift toward connected TV, retail media networks and other media that can leverage first-party data and enable more granular measurement; and a shift away from a focus on “premium” content with high production budgets to advertising plans that use contextual targeting through vertical, special-interest content.